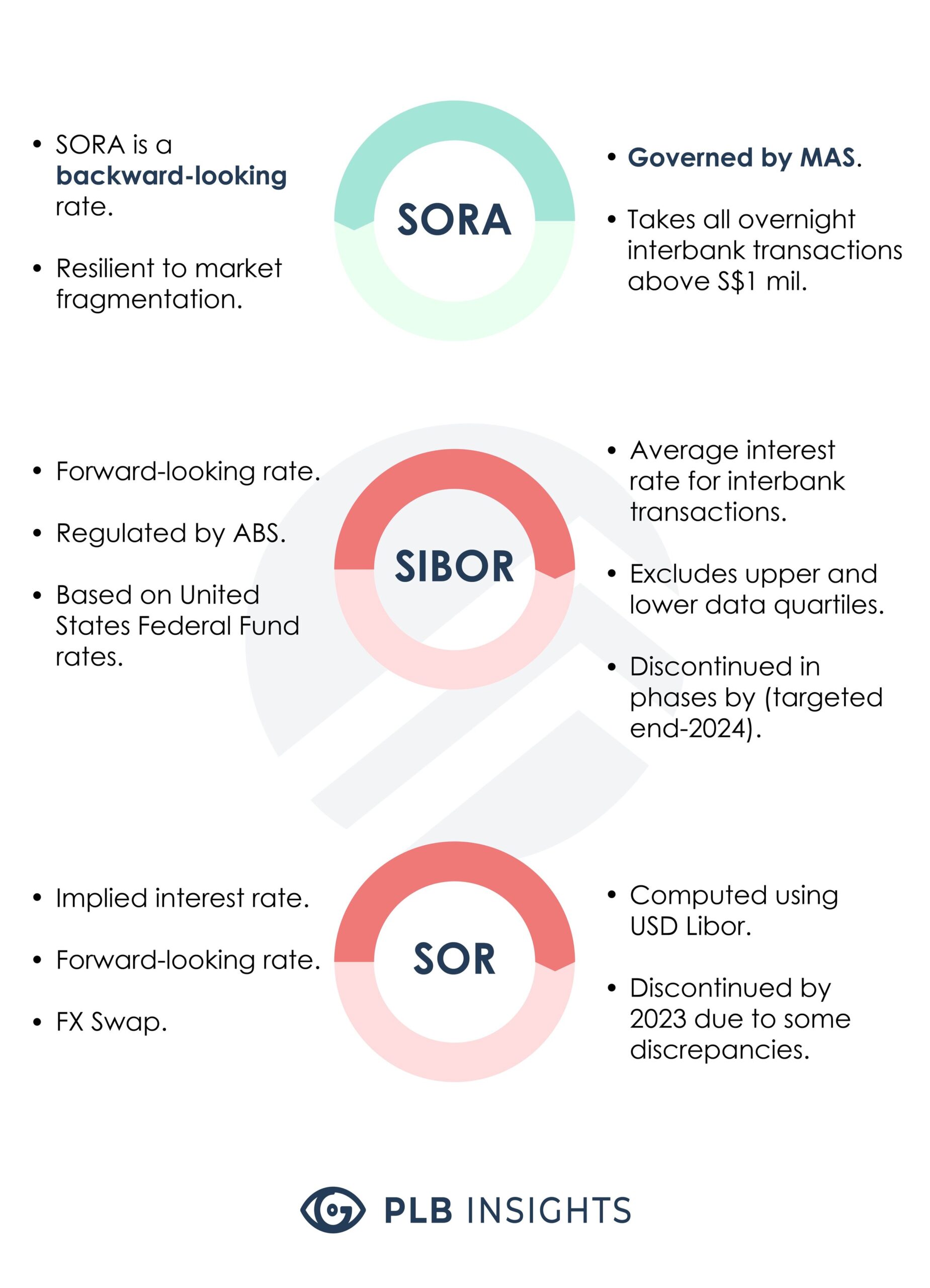

Along your property journey, you may encounter one or more of these terms, and a quick google search will be your succour. But we’ll break these down, and find out why SORA is going to be better off for homebuyers (or not).

What is SIBOR?

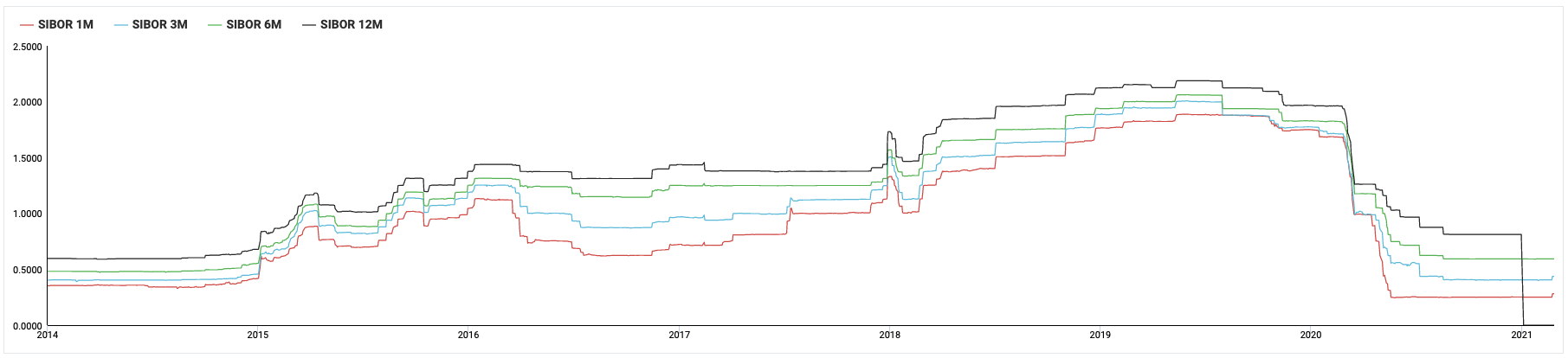

SIBOR is the Singapore Interbank Offered Rate. It is the average interest rate that banks borrow from each other (yeah, they do that because banks don’t hold on to all their cash, in accordance to the fractional reserve banking formula), which is regulated by the Association of Banks in Singapore (ABS). It’s readily available on their website. There’s three types of refreshed tenures/maturities; 1-month, 3-months, 6-months or even 12-months, however, most Singapore banks recognise only monthly or quarterly interest rates. It is usually used for home loans.

The problem, though, is that it is based on United States Federal Fund rates as well, which fluctuates based on their rates.

SIBOR being phased out

Discontinuation of the remaining SIBOR tenors will be in phases over the next four years, beginning with the 6-month maturity by end-2024. Basically, SORA is termed to be more robust and stable, hence the shift.

Additional info: Based on consultations led by the SC-STS in mid-2020, (Steering Committee for SOR and SIBOR transition to SORA) results showed that SORA came up on top with the least volatility.

Image courtesy AFP Photo.

What is SOR?

SOR is Singapore Swap Offer Rate (SOR). A Foreign Exchange (FX) -implied rate calculated from a formula that is another interbank lending rate. Generally speaking, it is based on the exchange rate between the USD and SGD, computed using USD Libor (another average interest rates for London’s international banks). It is usually used for commercial and wholesale loans. SOR is administered by ABS.

Simply, reflecting what the interest rate would be in USD, according to USD Libor.

The beef with SOR

New transactions will soon cease by 30 June 2023 using SOR as a benchmark, following the USD Libor’s ceasing to exist due to some serious interest rate manipulation(s) as far back as 2003. While USD Libor will continue to be published till 30 June 2023, along with SOR following suit, it will not be used for future lending contracts.

Illustration courtesy Patrick Chappatte and NYTimes.

Currently used to price derivatives and business loans, the “SORA-centred approach will better position SGD financial markets… allowing users of SGD floating rate products, including retail consumers and SMEs with products that reference SIBOR today, to benefit from a deeper and more efficient market”, says Samuel Tsien, ABS and SC-STS Chairman.

Discontinuation of SIBOR tenors have led to the adoption of SORA. Though tests were conducted for a potential enhanced SIBOR, it was concluded that SORA was less volatile. One of the potential issues with SIBOR, is how it is set, as the rate is collected from 20 member banks. If a minimum of 12 bank fail to report for that day, SIBOR rate is not calculated. The top and bottom quartiles are discarded, and an average is calculated as a benchmark.

In the near future (and finalised), SOR will be outdated and no longer relevant to today’s loaning landscape.

What is SORA?

SORA is Singapore Overnight Rate Average, published by the Monetary Authority of Singapore (MAS) based on the average rate of unsecured overnight interbank SGD transactions brokered within Singapore. It is computed based on actual transactions will be the future of interest rates, offering more stability than forward-looking term rates than SIBOR.

Benefits of a SORA-centred interest rate market

Due to its backward-looking overnight rates with an average weightage, it has a higher resilience to market fragmentation, facilitating improved transparency and an easier comparison of loan pricing.

How SORA came to be in Singapore

SORA was introduced to Singapore as it meets IOSCO Principles for Financial Benchmarks, based on recommendations from the ABS and the Singapore Foreign Exchange Market Committee (ABS-SFEMC) given the likely discontinuation of LIBOR after end-2021. The situation is currently led by SC-STS, comprising key bank representatives, relevant industry associations and MAS.

This directive stemmed on a global scale, with reform efforts from the UK Financial Conduct Authority, the supervisory authority of LIBOR, stating banks will no longer be compelled to submit exchange rates (which is used for LIBOR) after end-2021. As SOR is sort of pegged to USD Libor in its computation, the cessation led to SORA as the eventual alternative, with welcoming response.

The extended analysis and timeline is rather lengthy, so for more info (we know you’re out there, info guzzling grizzlies) do check out the latest on ABS’s site.

A breakdown — how does SORA work?

SORA’s rate of borrowing transactions are computed from within the unsecured overnight interbank SGD cash market in Singapore between 8.00am and 6.15pm.

This “unsecured overnight interbank SGD borrowing transactions”, for those still on the learning curve, means

where a reporting bank borrows SGD cash overnight from another bank.

Each transaction that reporting banks make, have to meet these criteria

-

Is an unsecured overnight interbank SGD borrowing transaction

-

Traded with onshore banks and booked in the timing inclusive window

-

According to local and overseas central-booking arrangements approved by MAS

-

Settled on a trade date

-

At least S$1 million

With the MAS at the helm, an elaborate breakdown can be found in the MAS’s methodology breakdown.

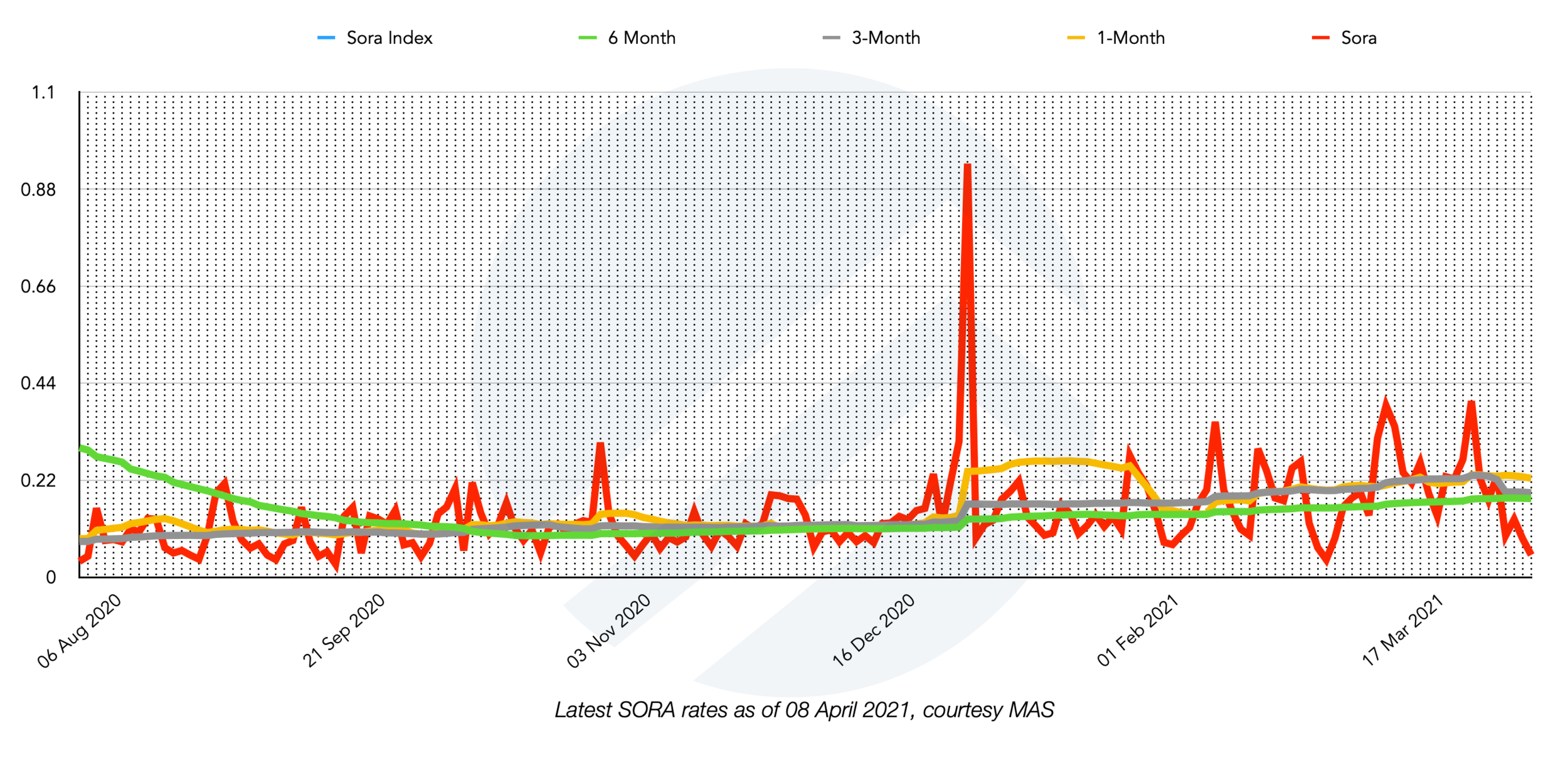

Here are current rates of SIBOR, SOR and SORA (Accurate as of time of writing, 6 April 2021)

SOR, SIBOR and SORA rates (as of latest, 8th April 2021)

From this, SIBOR is currently at an all-time low, though noticeably, SIBOR’s slight recovery has started in Feb 22.

The latest update as of 8th April 2021, is

1-month compounded SORA — 0.2245

3-month compounded SORA — 0.1918

6-month compounded SORA — 0.1785

What’s the latest update of SIBOR, SOR and SORA?

According to The Straits Times, financial institutions will have to cease issuing SIBOR-linked financial products and SOR derivatives by end of September this year, as part of pushing the industry towards SORA as the main interest rate benchmark.

More can be found in a recent consultation held in mid-2020.

Image courtesy SBR.

Our opinion of SORA

With how SOR and SIBOR fluctuates and dependency on other countries’s cash movement, MAS will be overseeing SORA’s transactions for more transparent rates, which are proven to less volatile and on the contrary, more robust and stable.

While this might not seem to have an effect for property homebuyers, it does. With all the rage of instability and manipulation its predecessors, the situation does call for a more stable benchmark, which bodes well for home mortgages.

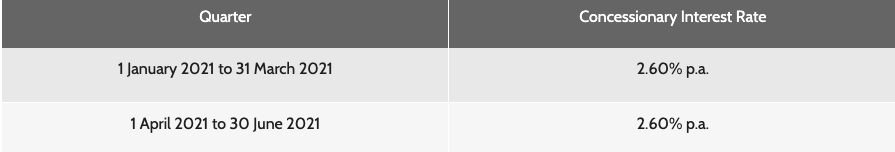

Comparing to HDB loans

HDB loans are pegged to 0.10% above the existing CPF Ordinary Account (OA) interest rate, which is adjusted quarterly.

Image courtesy HDB.

A simple calculation are as follows

Monthly interest payable= Outstanding loan balance (on the 1st of the month) X prevailing interest rate (per annum)/12.

If you were to take SORA, or even say, utilise a loan to replace your HDB loan, it is possible. In fact, you could shave off a few valuable percentages from your initial HDB loan interest. By the way, SORA has been statistically proven (based on the graph above, and compared to DBS’s published rates) to be lower than SIBOR rates, so yay to us homeowners.

Say a 4-room flat is purchased at $500,000.

Based on the LTV ratio for HDB, which is capped at 90%, you are able to take a $450,000 loan over 25 years. However, for the sake of comparison to a bank loan, supposing the rest of the $125,000 is settled via CPF and savings, we will take a $375,000 HDB loan. The monthly interest payable works out to be $1701 per month, based on the Monthly Instalment Calculator from CPF Board.

Total paid = $510,378

HDB loan Interest rate = 2.6%

Interest accumulated = $135,378.20

Monthly repayment = $1701

While you do enjoy a stable 2.6% interest rate and a higher Loan-to-Value (LTV) ratio, it doesn’t really translate to massive savings. In addition, there are conditions such as income ceiling, Singapore citizenship for one spouse and private property ownership.

Compared to bank loans, the interest rate ranges between 1.2% to 3% per annum. The LTV though, is up to 75%, with a down payment of up to 25% (5% paid using cash). There are two options, namely fixed rate packages and floating rate packages. Fixed rate presents an interest rate between 1-5 years, while floating rate packages varies.

The pros for housing bank loans will definitely be its lower interest rate and an easier criteria. However, it does pose some cons, such as 1.5% penalty for early repayment, higher down payment and fluctuating interest rates.

A comparison based on UOB’s 3-month compounded SORA Package, and basing on the existing 3-month compounded SORA — 0.1918, we can use this for comparison.

Supposing the purchase requires a $450,000 loan, and we

$375,000 loan amount based on a 75% loan, and 25% down payment, we get $375,000 for the loan amount.

That means, the purchaser has to fork out $125,000 by cash or 5% minimum cash, together with the remaining by CPF (OA).

The interest is then calculated based on the how UOB has packaged it.

Year 1 – 3M compounded SORA + 1.25% p.a

Year 2 – 3M compounded SORA + 1.25% p.a

Year 3 and subsequent years – 3M compounded SORA + 1.40% p.a

For convenience’s sake, we will use Year 3 as the benchmark per annum interest rate. 25 years loan, assuming the down payment of $125,000 can be paid.

Loan amount from bank = $375,000

Interest Rate = 0.1918 (assuming it does not change, based on its claim to stability) + 1.40% p.a = 1.5918%

Monthly repayment= $1,516

Total paid = $454,800

Interest accumulated= $79,800

In comparison, a $375,000 bank loan will save $185 monthly, and ultimately save $55,578.20. That’s uh, quite substantial, assuming SORA rates maintain its affordable rate.

The apparently slight difference in interest that accumulates in the long run. While banks will now offer a more stable interest rate, it does not necessarily mean feasible for all scenarios. HDB bank loans have lesser volatility, compared to bank loans, which still have fluctuations.

To end off, we feel that we’re entering into a more stable borrowing era with SORA as the de facto for interest rate benchmarks, though it is internally regulated, might bode off better for investors and homeowners alike. For banks, it will result in lower default rates and a more stable environment. But for now, let’s await for the middle of this year for more things to developed. Stay tuned.

This article is unsponsored, aiming to provide readers with greater insight for loan rates. For more information on HDB Loan vs bank loans, check out Singsaver’s link.

Information is derived from ABS, MAS and other references found here. Information is updated as of time of writing, and may not reflect the latest developments of interest rates.