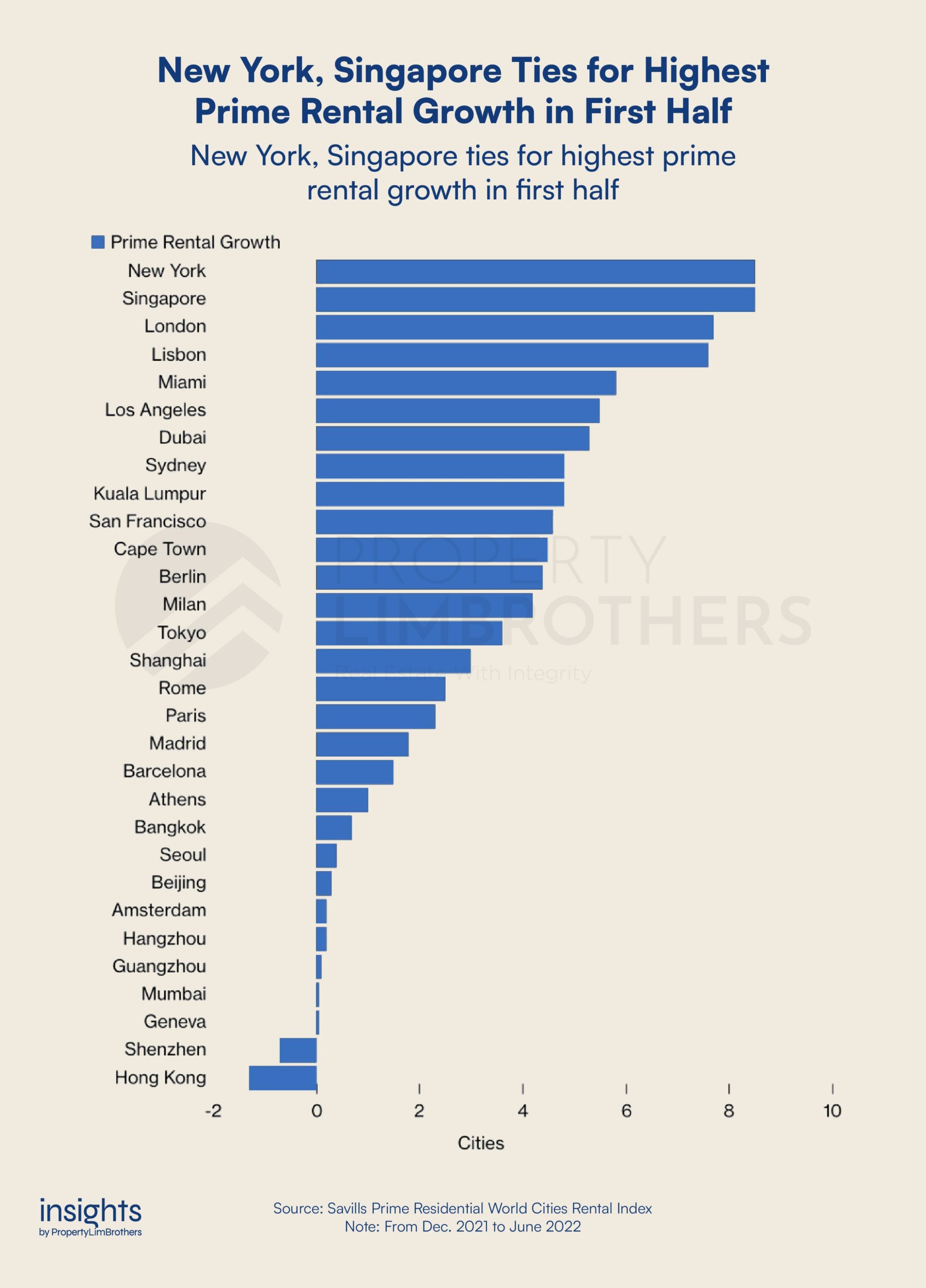

The rise of rental prices in Singapore has been on a streak. HDB rents are on a 2-year rising streak since the pandemic started and Condo rents are on a 1.5-year rising streak. The unbelievably heated rental market is accompanied by rising housing prices as well. In just the first half of 2022, the rental price growth has already reached 8.5%. This ties with New York for the highest rental growth among 30 cities.

Are these high prices sustainable? Are they temporary or here to stay? The worries of an exploding cost of living are not unfounded. Inflation is hitting Singapore’s housing market hard. And while most households might not feel it just yet, in the next step of the property journey people will start to question why the price of new homes is so expensive.

In this article, we explore some of the possible reasons why the rental market in Singapore has been on a streak and speculate on where it might be headed. We look at the pros and cons of rising rents and compare it with the situation in other cities.

Why are Rental Prices Rising?

Price is a reflection of demand and supply mechanics in the market. Price rises typically because of an increase in demand or a reduction in supply. For the rental market in Singapore, the current hike in rentals is most likely due to a boost in rental demand, coupled with a supply delay in the provision of new HDB flats and residential developments.

The steep rise in prices for rentals might be due to a host of different factors. The pandemic wreaked havoc on global supply chains, and brought a labour shortage to many sectors. Construction of residential projects, both public and private, was delayed. In addition, the work-from-home trends pushed people to look for larger living spaces. However, specific to the rental market, it is often the case of poor timeline planning or certain circumstances that pushed people to find a rental solution. Most commonly, it is due to sellers having sold their homes but are unable to prepare a new place in time. Either the renovation is incomplete or that they couldn’t find a suitable new place at a reasonable price.

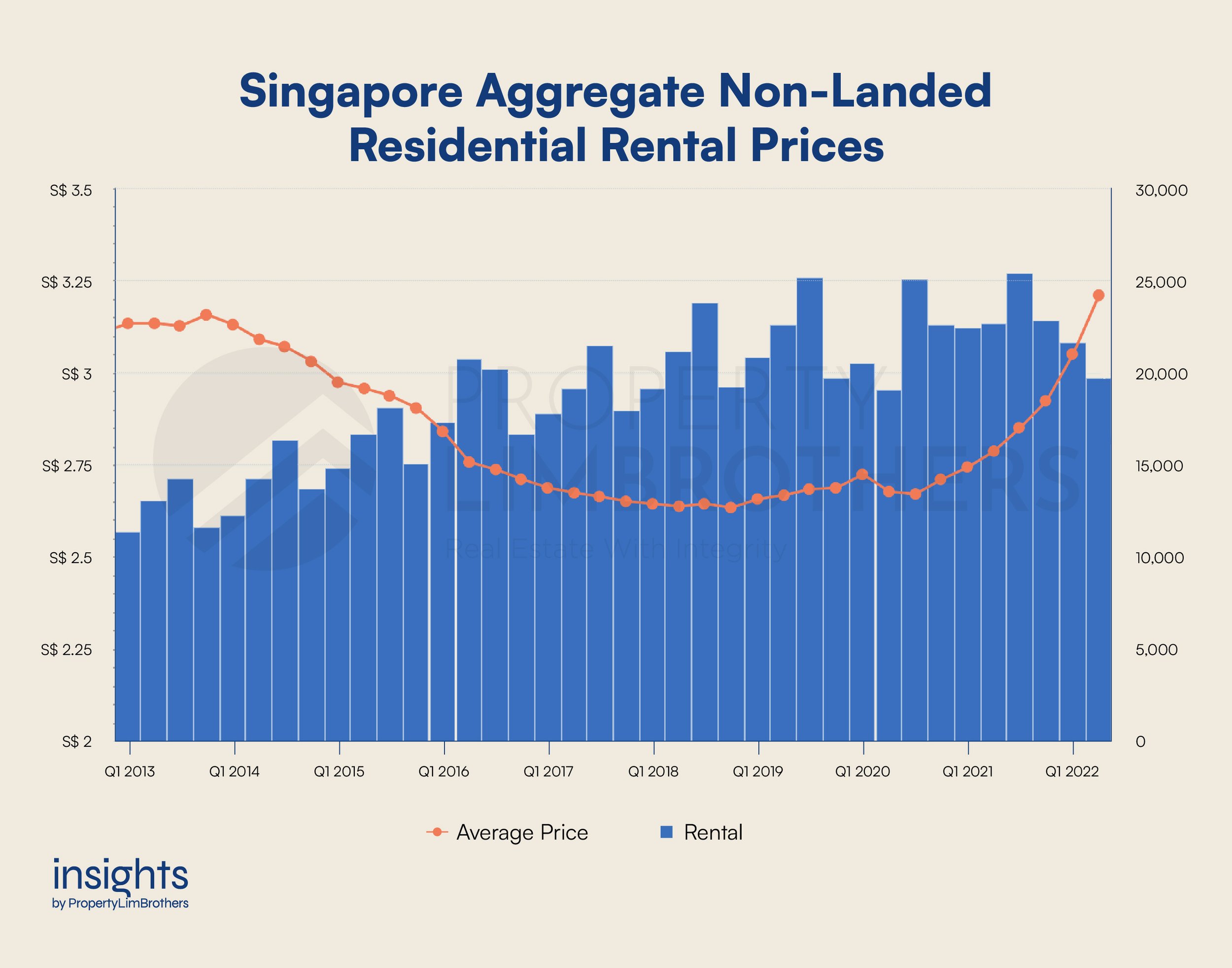

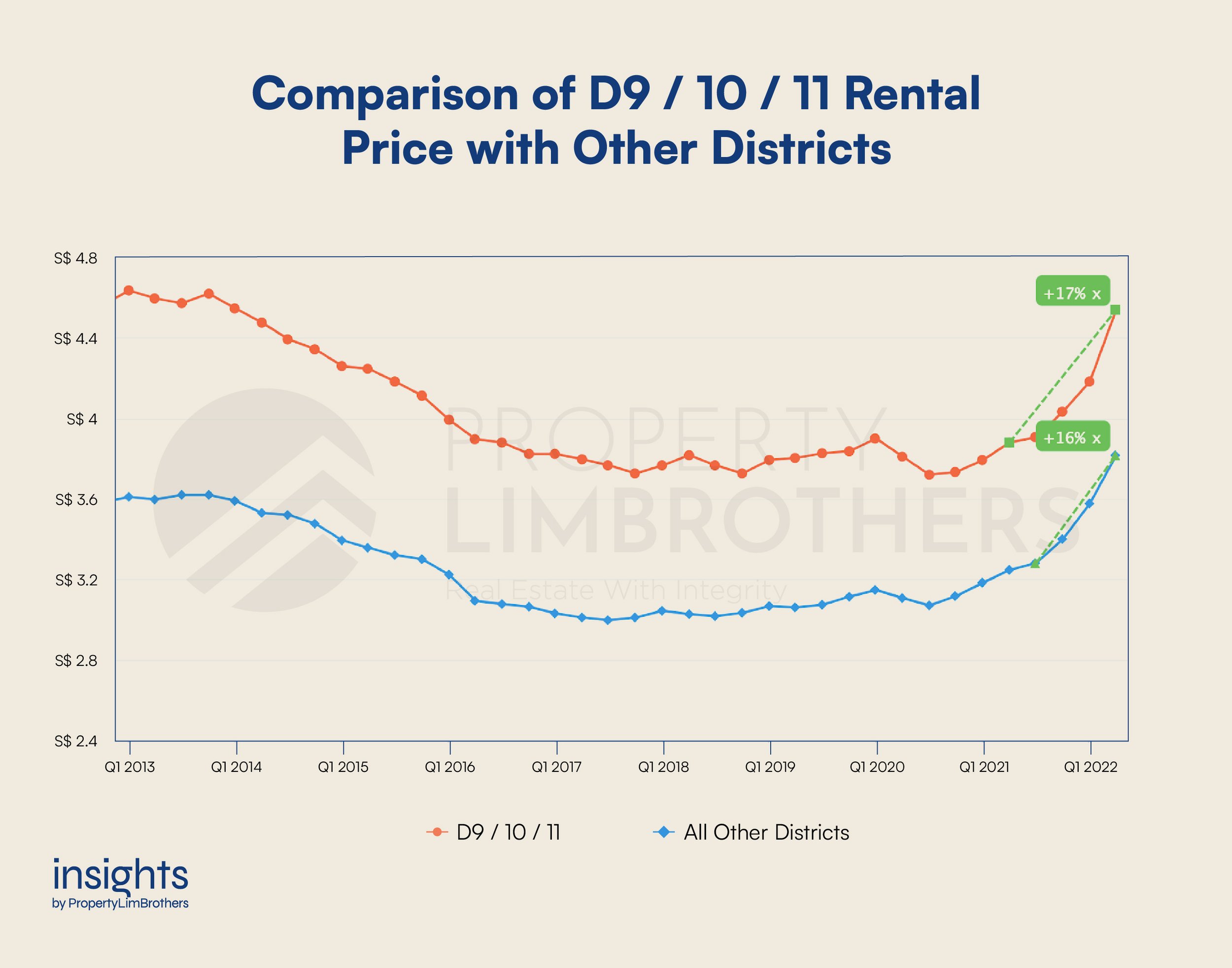

Most of the steep rise in the rental market was seen in the past 24 months. It is not difficult to see that the pandemic had a large impact on the rental market. Prior to 2020, the rental market was largely declining from the end of 2013 into 2017. Prices started to stabilise from 2018 onwards.

This is largely due to a large spike in Government Land Sales (GLS) for residential purposes in the OCR from 2010 to 2012. After these residential developments were completed and hit the market, we could see rental prices start declining. This period also coincided with the cooling measures put into place from 2009 to 2014.

Prices have made a parabolic move up in the past 4 quarters, however, the volume of transactions has been shrinking. Looking at the seasonality of the data, quarter 3 tends to be the one with the highest volume of transactions in each year. Volume usually builds up and reaches a peak in quarter 3. In 2022, volume has been declining since the quarter 3 of 2021. Simultaneously, the rental prices made a new high of $3.21 in quarter 2, taking out the previous high of $3.16 in quarter 4 of 2013.

If prices continue to rise as volume consistently shrinks, we might be seeing an unsustainable price level in the market. Fewer individuals would accept a high rental price, and more landlords would be inclined to lower prices lest they leave the property untenanted. The next few quarters will tell us if the rental market is building up a bubble or not.

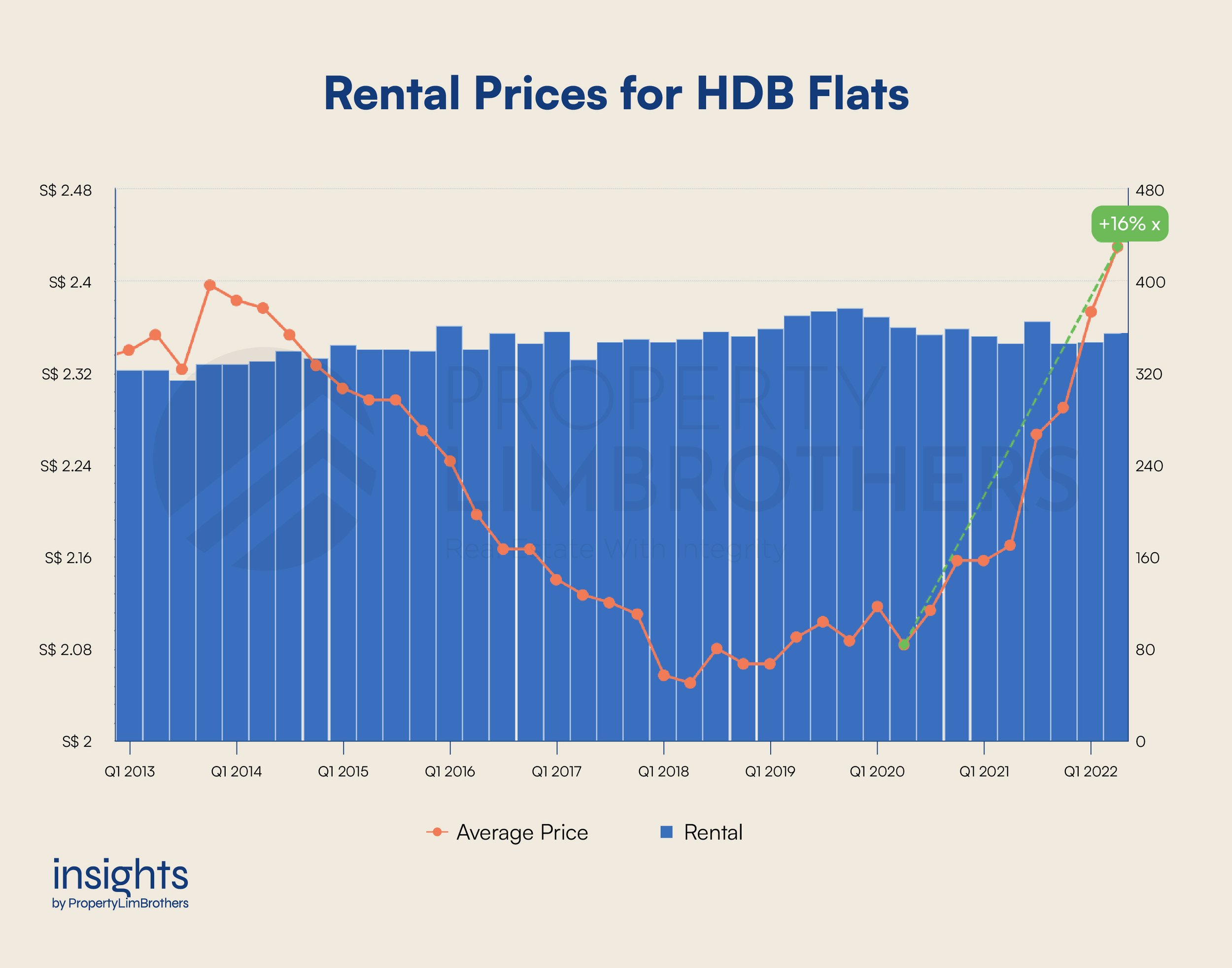

While the aggregate rental prices suggest a potential bubble formation, HDB rentals have an increasing transaction volume with prices. This is a much healthier uptrend. Similar to the aggregate price levels, HDB rental prices have recently made a new high with its 24-month parabolic move up.

Given the current macro conditions in the property market, it would seem that HDB rentals have a higher chance of remaining at elevated levels. The charts alone do not seem to suggest a decline in rental prices any time soon.

A forward indicator that rental prices will drop in the future would be if the government increases land sales for residential purposes in the following years. Alternatively, if the construction delays and backlogs for BTO flats are rectified, rental prices might start coming down.

The condominium and apartment make up the largest rental market in Singapore by the volume of transactions (chart above). It has a much higher chance of price decline than HDB rentals if the volume continues to shrink. Higher prices might not be able to find sufficient willing renters. If prices continue to increase, renters might find more affordable rental options in the HDB rental market pushing the prices there higher instead.

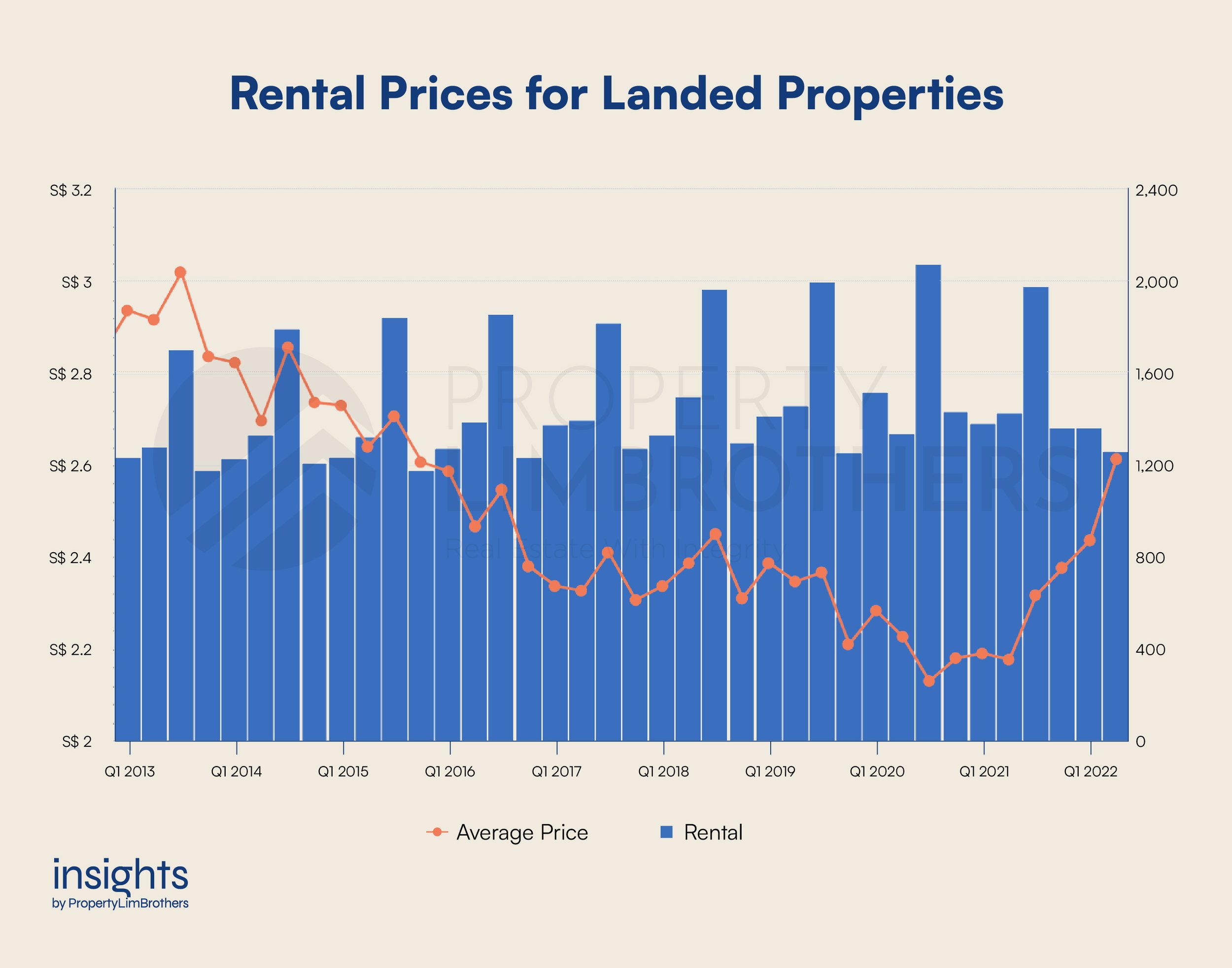

The rental market for landed properties on the other hand is rather unique. It has not yet hit the previous high made in 2013 unlike the HDB and Condo rental markets. This might suggest that landed property rentals might have a higher upside than the other two markets.

Why are rental prices rising? And will it continue to rise? We might not have a crystal ball that can predict the future but the charts do have a story to tell. Rental prices have risen possibly due to a surge in demand from people who want their own place. BTO delays, work-from-home, health and safety reasons. These are all stories that fit the bill when it comes to rental prices going up.

As to whether prices will continue to rise, most probably in the short term. Inflation is a hot topic at the moment and the cost of rental is no exception. Between the different rental segments, Condo rentals are the one to watch to see if a bubble is forming in the rental market. Otherwise, HDB and Landed rentals seem to still have potential to keep rising in the short run.

Are there Benefits to High Rental?

This is quite a mad thing to ask. Especially if you’re on the tenant side. Since when are high prices ever a good thing? Are there any real benefits to high rental? Well, give us a moment to explain this. As we mentioned earlier, Singapore’s residential properties have been climbing up in price in tandem with rental prices. In order to support the rising home prices, rental prices should continue to rise also.

Apart from the obvious (high rentals benefit the landlord), a high rental price is needed to substantiate a sustainable rise in home prices. Otherwise, it might be a signal that a bubble is forming in the housing market. We have a previous article here, exploring whether that is happening as we speak.

Basically, incomes and rentals need to rise together with housing prices in a healthy market. If either income or rental falls behind, it suggests a sort of sickness in the market. Either houses are being bought too speculatively, or that the rest of the economy is not able to support the move up in housing prices.

Either way, it is quite likely that elevated rental prices might be here to stay in the medium term. As rental prices started to fall from 2014 to 2017, the property prices were mostly consolidating and remaining stagnant. Since then, property prices have risen substantially. Rental prices were playing catch up to property prices over the past two years. On a big picture level, this is a more preferable outcome than if rentals remained low.

Is the Increase in Rent Reasonable Compared to Other Cities?

Looking at how fast rent and property prices have risen are a shock to most people. But one segment is particularly fazed. Expats in Singapore are facing dizzying rent hikes, from 40% to over 100% rent hikes are on the table for properties in prime areas. Based on the interviews conducted by Bloomberg, it seems that most of the expatriates in Singapore do not accept the greedy asking prices of some landlords.

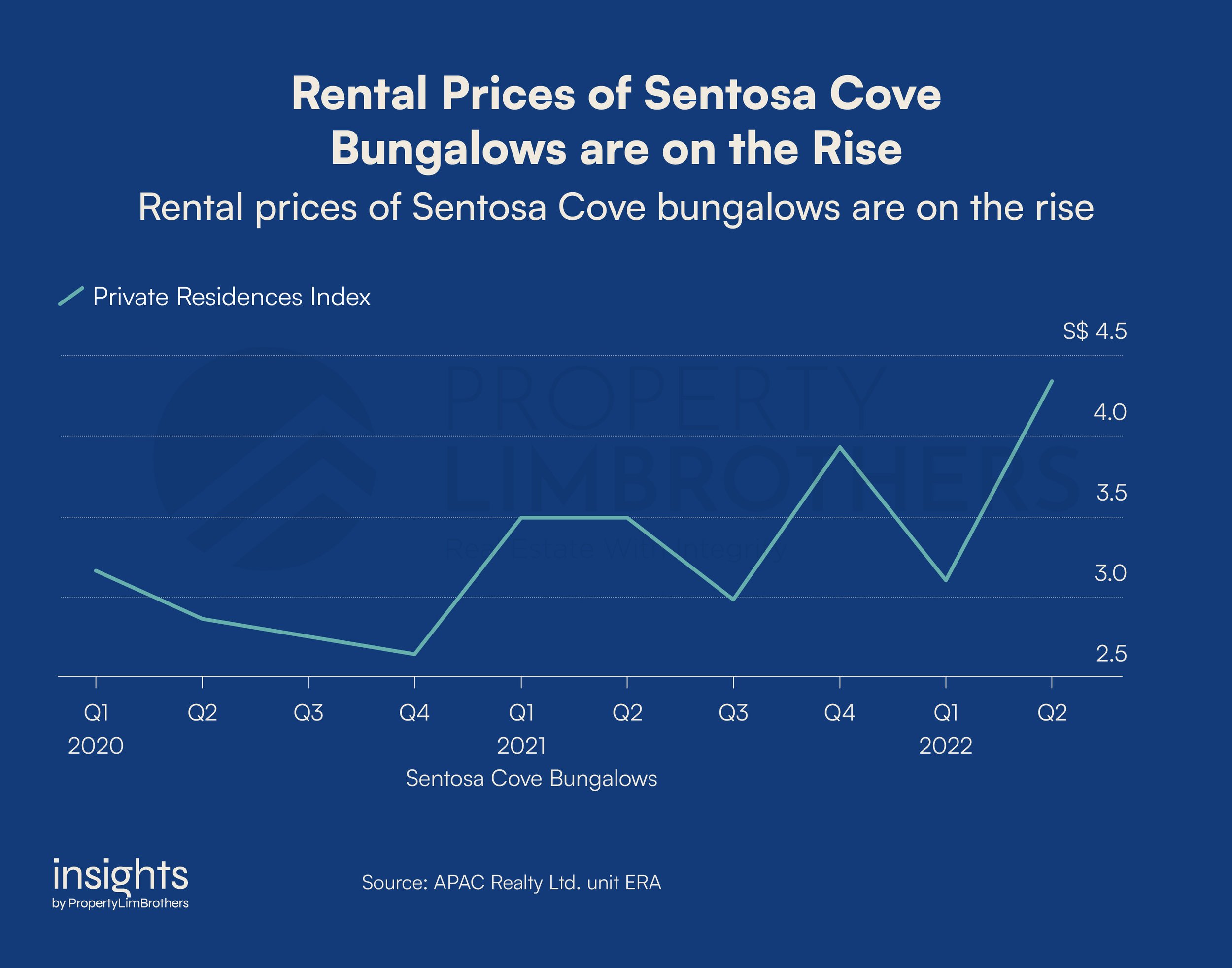

While prices are definitely on the rise, are the exorbitant asking prices by some landlords reasonable? The rental market for prime houses is definitely hot, the rental growth of Sentosa Cove Bungalows are approximately double of the aggregate growth rate of non-landed private rentals (16%).

However, Sentosa Cove is a very small slice of the rental market. Even the luxury condo segment (D9/10/11) in the central area has a comparable rental growth rate as compared to other districts in Singapore. Interestingly, other districts have surpassed their previous high in 2013 but D9/10/11 private condominiums and apartments have not made a new high yet in rental price.

The following months might still see the luxury property market slowly digesting higher rental prices. While a 40-100% increase is definitely not the norm, it is very likely that a large amount of rental contracts will be renewed in the coming quarter. This seasonal renewal will be a big hint as to whether the market will continue to let prices spiral upwards.

Among 30 other cities surveyed by Savills, Singapore tops the charts as the one with fastest growing rents (at 8.5%) in the first half of 2022. This is ahead of London, San Francisco, Tokyo, and Paris. Hong Kong places last with negative growth in its rental prices.

From the chart below, we can see that Singapore’s rental market is experiencing higher than average inflation. While this might be due to persistent local supply issues in the housing market, a solution would eventually be needed. Since supply issues can only be solved in the course of the coming years, a more immediate solution might be needed in the rental market.

The Singaporean government might be adverse to price controls in the rental market, and would probably not be willing to curb foreign talents from coming in. But it will likely step in on any rental scams looking to take advantage of the situation in the heated market.

Whether this rental increase is reasonable or not is another question. Singapore is a great place to do business in. It attracts business owners from all over the world to set up shop. It’s generally a safe city that is relatively sheltered from natural disasters and geopolitical instability. Clean, green, with great transport infrastructure.

It is hard to compare what is reasonable across so many different cities. However, Singapore is an expat favourite in Asia. It is not particularly surprising to see it top the chart in 2022. With many black swans lurking about in 2022, many global citizens might choose to live in a safe haven.

Closing Thoughts

Singapore’s rental market is on a streak and might continue to rise in the micro term. It may continue to make headlines, but real estate investors should pay keen attention to the health of the rental market for condominiums and apartments. Shrinking volume and collapsing rental prices, may have larger implications for the rest of the market and indicate where the market may go for the next few quarters.

If you wish to find out more about how the rental market might affect you in today’s turbulent market, contact us here to have an in-depth discussion. If you’re looking for a place to stay, or intend to rent out your property, have a chat with us to find out if high prices are here to stay and let’s discuss more on what the right strategy is for you. We hope that this article has been helpful! Thank you for taking the time to read it this far.