Q4 recovery offsets a 0.7% dip in the previous quarter

Singapore’s private residential property market ended 2024 on a strong note, with prices rising 2.3% in the fourth quarter. This rebound brought the full-year price increase to 3.9%, according to flash estimates released by the Urban Redevelopment Authority (URA) on Thursday (Jan 2). While this marks a slowdown from the 6.8% growth in 2023 and 8.6% in 2022, it reflects the resilience of the property market amidst changing macroeconomic and regulatory conditions.

Non-Landed Properties Drive Recovery

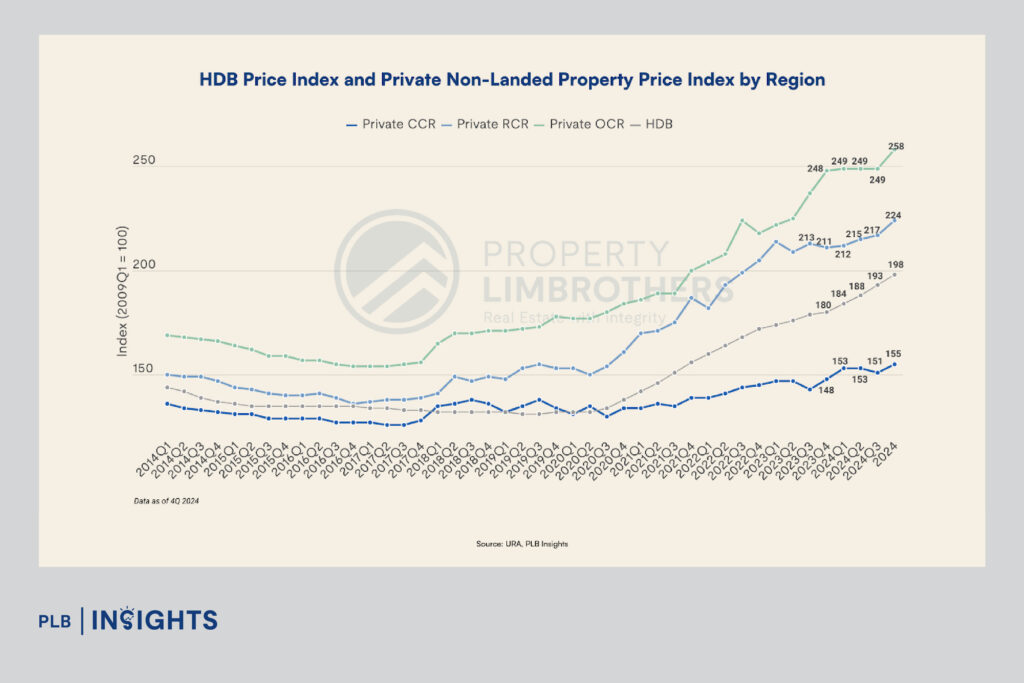

The recovery was spearheaded by non-landed private properties, which saw prices jump 3.2% in Q4, a significant uptick from the marginal 0.1% growth in the preceding quarter. All regions reported robust growth:

Landed Properties Continue to Decline

While non-landed properties surged, landed homes continued their downward trajectory, with prices slipping by 0.9% in Q4, following a 3.4% decline in Q3. This marks a rare divergence within the market, with landed properties facing headwinds likely tied to affordability constraints and cooling measures targeting higher-priced assets.

Year-on-Year Growth Moderates

The full-year growth rate of 3.9% reflects a tempered pace compared to the post-pandemic surge seen in 2021 and 2022. This moderation aligns with the impact of the government’s cooling measures, including increased Additional Buyer’s Stamp Duty (ABSD) rates for foreigners and multiple-property owners.

Sales Volumes Surge in Q4

Transaction volumes rose 25% quarter-on-quarter in Q4, reaching 6,715 units as developers launched more projects. However, annual sales volumes for 2024 stood at approximately 21,232 units by mid-December, 14% below the annual average of 24,830 units recorded between 2021 and 2023.

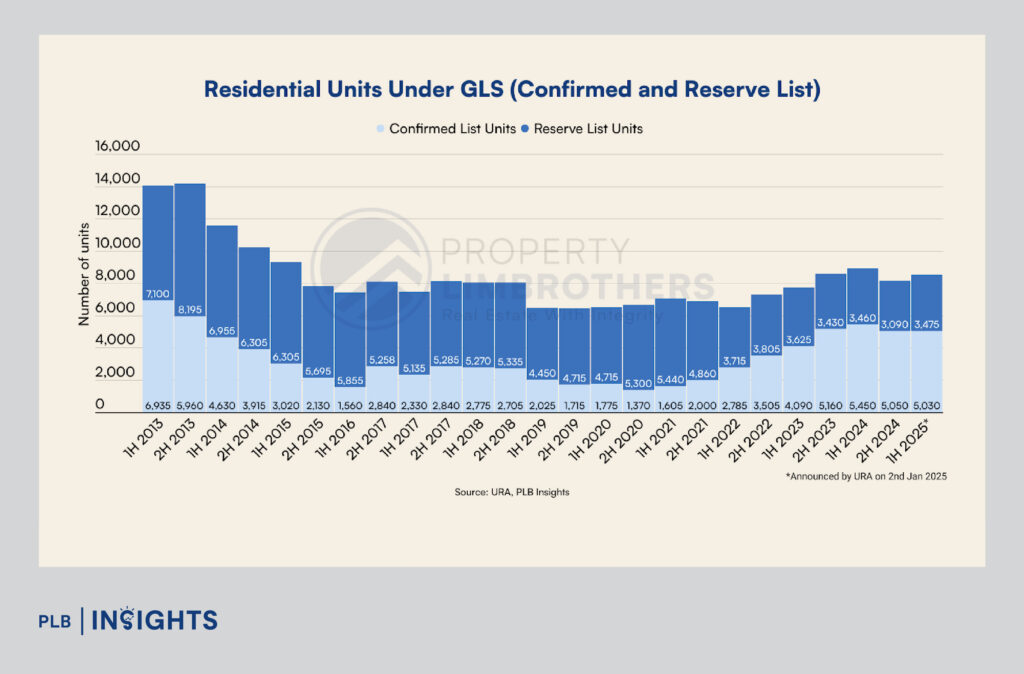

Increased supply under the Government Land Sales (GLS) Programme

To address housing demand and support market stability, the Government has increased the private housing supply under the Government Land Sales Programme from approximately 8,140 units in the second half of 2024 to 8,505 units in the first half of 2025. This includes around 5,030 private residential units—of which 980 are Executive Condominium (EC) units—that will be released via the Confirmed List in 1H2025. This represents nearly a 60% increase compared to the average half-yearly Confirmed List GLS supply from 2021 to 2023. Additionally, 3,475 units will be made available through the Reserve List, exceeding the 3,090 units offered in 2H2024.

HDB Resale Prices Maintain Momentum with 2.5% Q4 Gain, Annual Growth at 9.6%

Price growth eases slightly from Q3’s 2.7%

Singapore’s HDB resale market continued to see robust price growth in Q4 2024, with resale prices rising 2.5% compared to the 2.7% increase recorded in the previous quarter. For the full year, resale prices grew by 9.6%, highlighting the sustained demand for public housing amid tighter supply conditions.

Strong Demand Meets Limited Supply

“The resale price increases in Q4 reflect broad-based demand and supply tightness,” HDB noted. However, the slight moderation in growth signals the impact of the government’s cooling measures, including the August 2024 reduction in the loan-to-value (LTV) limit for HDB housing loans from 80% to 75%.

Resale Volumes Dip in Q4

Resale transactions fell slightly, with 6,314 units changing hands in Q4, down 3.6% year-on-year. For the full year, total resale volumes reached 28,876 units by Dec 30, representing an 8% increase compared to the 26,735 units sold in 2023.

BTO Launches and Future Supply

HDB introduced 21,225 new flats in 2024, comprising 19,637 Build-To-Order (BTO) flats and 1,588 units under the Sale of Balance Flats (SBF) exercise. Looking ahead, HDB plans to launch approximately 5,000 BTO flats in February 2025 across Kallang/Whampoa, Queenstown, Woodlands, and Yishun. The exercise will also feature the largest SBF launch ever, with over 5,500 units available across various estates.

Policy and Market Stability

HDB emphasised the importance of prudent purchasing decisions, especially as market cycles can shift.

“Households are strongly advised to exercise caution in property purchases to avoid potential financial risks if prices soften,” HDB stated.

The agency reiterated its commitment to promoting a stable and sustainable property market, with plans to monitor conditions closely and adjust policies as needed.

What Lies Ahead?

The Q4 recovery in Singapore’s private residential market signals resilience amid ongoing macroeconomic challenges and regulatory interventions. For HDB flats, robust demand and limited supply are expected to sustain price growth into 2025, though at a moderated pace.

As Singapore enters the new year, the interplay between supply, demand, and government policies will remain pivotal in shaping the real estate market. Whether you’re a buyer, seller, or investor, staying informed about these dynamics will be key to navigating opportunities and risks in 2025.

For a comprehensive analysis of Q4 property trends and insights into 2025, stay tuned to PLB Insights for our FY 2024 and Q4 2024 Research Report!

Stay Updated and Let’s Get In Touch

Questions? Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.