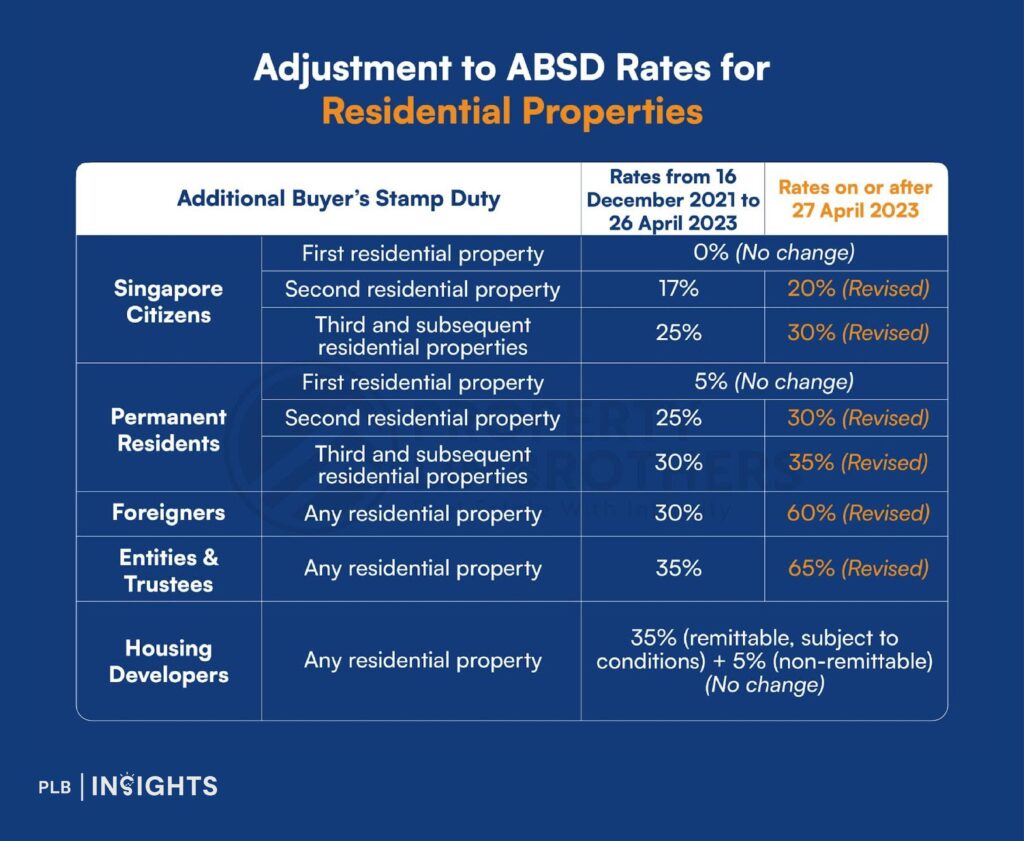

Over the past decade, the Additional Buyer’s Stamp Duty (ABSD) has been pivotal in regulating Singapore’s property market and ensuring affordability. Yet, rising ABSD rates—particularly for foreigners—now pose new challenges, notably for the Core Central Region (CCR).

Will The 60% ABSD Kill CCR Projects And Exacerbate Increasing Housing Prices In The RCR And OCR?

Introduced in 2011 to curb surging home prices and speculative buying, the ABSD added a layer of financial accountability to Singapore’s property market. However, the latest revisions in April 2023, which impose a steep 60% tax on foreign buyers, have reshaped purchasing patterns significantly. Foreign buyers, deterred by the high tax, are avoiding CCR properties and turning instead to more affordable options in the OCR and RCR. This shift risks stagnating demand in the CCR while inflating prices in the OCR and RCR, intensifying competition and straining housing affordability for Singaporeans.

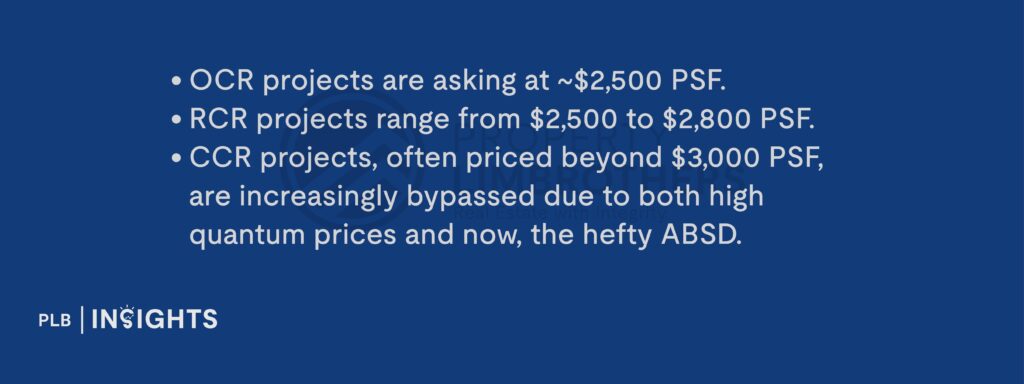

To put this in perspective:

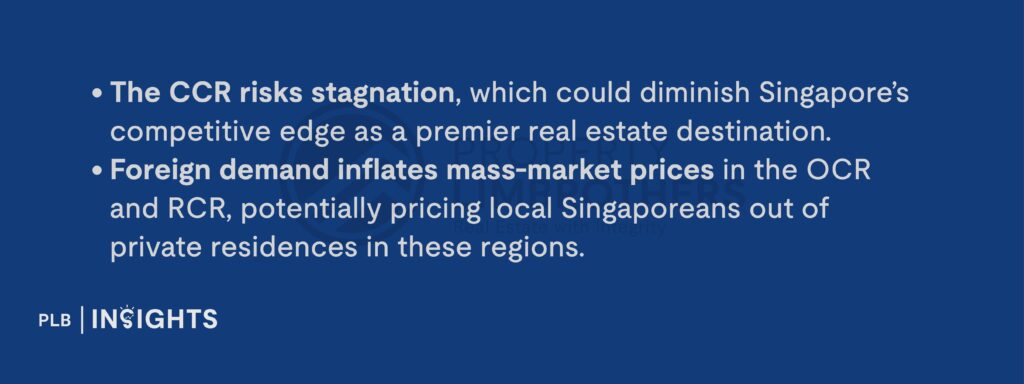

While the demand for OCR and RCR projects rise, it creates two key challenges:

To address this imbalance and safeguard affordability for locals, a more refined approach to ABSD should be considered.

Our Proposal: A Tiered Approach for CCR Properties with Foreign Buyer Restrictions

If left unaddressed, the current trajectory could lead to an imbalance in Singapore’s property market. CCR projects, long regarded as the pinnacle of Singapore’s real estate landscape, risk becoming obsolete to foreign buyers. Meanwhile, locals face increasing competition for homes in the OCR, which are traditionally viewed as mass-market options.

To address this, we propose a two-pronged approach which introduces a policy that restricts foreign buyers to purchasing only in the CCR, combined with a proposed creative tiered ABSD system may be helpful to ensure demand is redirected appropriately while safeguarding local affordability.

1. Restrict Foreign Buyers to the CCR

Real estate is a cornerstone of Singapore’s economic growth, but the blanket 60% ABSD for foreigners risks stifling activity in the CCR and leading to stagnation.

Our proposal of restricting foreign buyers to the CCR addresses this imbalance by channeling foreign capital back into this region, while reducing competition in the mass-market regions. At the same time, a tiered ABSD system for higher-priced CCR properties can stimulate demand in the central area, reinforcing its role as a premium real estate hub. This two-pronged approach distributes demand more evenly across all regions—CCR, RCR, and OCR—ensuring sustainable growth while safeguarding housing affordability for Singaporeans.

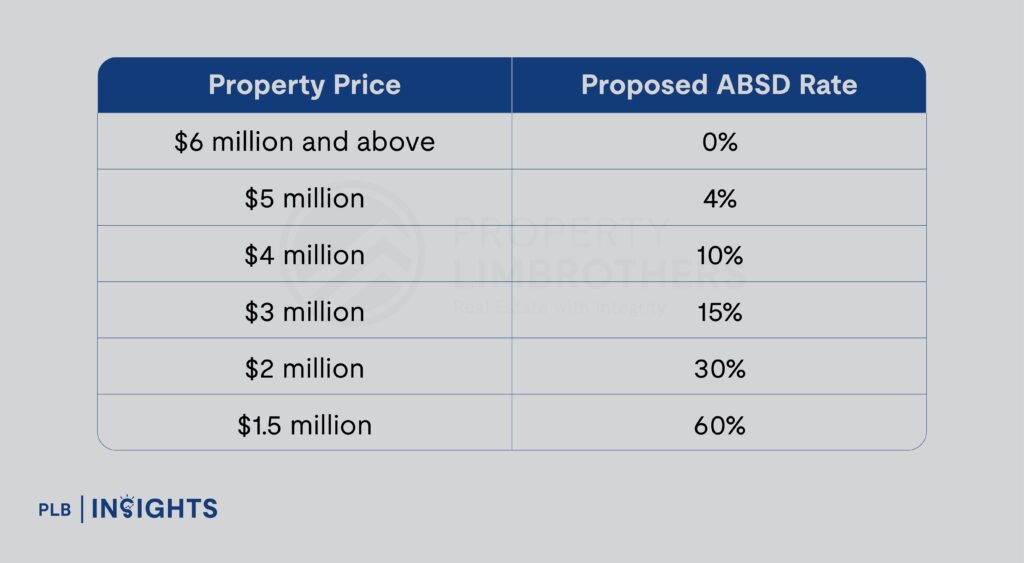

2. Tiered ABSD for CCR Properties

Instead of a blanket 60% tax, introducing a tiered ABSD system that reduces taxes on higher quantum CCR properties to stimulate demand while safeguarding mass-market housing for locals.

Our proposed tiered ABSD system takes a counterintuitive yet creative approach to address the challenges facing Singapore’s real estate market. While taxes typically target higher-value purchases to curb speculative buying, this proposal reverses that logic by easing taxes on higher quantum CCR properties. The rationale lies in encouraging demand for the luxury segment, which has been stifled under the current blanket 60% ABSD. By channeling foreign capital back into the CCR—rather than allowing it to spill over into mass-market segments—we not only revitalise activity in the central region but also protect affordability for Singaporeans in the OCR and RCR. This strategy strikes a careful balance: supporting sustainable growth in Singapore’s premium real estate market while safeguarding the interests of local buyers in the mass-market housing segments.

Looking Ahead: Balancing Policy and Market Realities

Singapore’s real estate policies have been instrumental in maintaining market stability and ensuring long-term affordability for its citizens. However, as the market evolves, so too must our policies. The current ABSD framework, while effective in curbing speculative activity, requires fine-tuning to address new challenges.

By implementing a tiered ABSD system and restricting foreign buyers to the CCR, we can:

Final Thoughts

The Additional Buyer’s Stamp Duty remains a vital tool in Singapore’s property landscape. Yet its unintended effects—particularly on the CCR and OCR segments—must be addressed proactively.

A two-pronged solution offers a practical path forward: tiering ABSD rates for CCR properties and limiting foreign buyers to the CCR. This ensures that CCR properties remain attractive to foreign buyers while safeguarding affordability for Singaporeans in the OCR and RCR. At the same time, it reinforces Singapore’s position as a premier global real estate market, where policies strike a thoughtful balance between regulation and opportunity.

As we move forward, policymakers, developers, and industry stakeholders must work together to ensure that Singapore’s real estate market remains vibrant, inclusive, and globally competitive. By fine-tuning our approach to ABSD and focusing foreign demand on the CCR, we can achieve a market that works for everyone—locals, foreigners, and future generations alike.

Curious about how Singapore’s property landscape is evolving and what it means for CCR properties? Our team of experts is here to help you make sense of the latest market dynamics and uncover opportunities that align with your goals. Whether you’re planning your next property move or exploring investment options, we’re here to provide tailored insights to guide you. Contact us today to get started.