With the recent wave of new condo launches, prospective buyers are encountering a significant shift in how units are measured and priced. This is due to the new Gross Floor Area (GFA) harmonisation rule, which aims to standardise measurements across government bodies, resulting in more streamlined and efficient floor plans. While on the surface this change might appear to be a technical adjustment, it actually impacts property prices per square foot (PSF), making new launch condos seem more expensive than before.

So, how does the GFA harmonisation rule work, and what does it mean for condo buyers? Here’s an in-depth look at what you need to know.

Understanding GFA Harmonisation: What It Is and Why It Matters

The GFA harmonisation rule, introduced by the Urban Redevelopment Authority (URA), is designed to unify how Gross Floor Area is measured across Singapore’s regulatory bodies, including the URA, Singapore Land Authority (SLA), and Building and Construction Authority (BCA). Previously, each agency applied its own criteria for calculating GFA, leading to inconsistencies that often confused developers and buyers alike. This new rule standardises the GFA calculation, providing clearer guidance on what should—and should not—be included in a condo’s sellable area.

At its core, GFA harmonisation addresses two critical issues. First, it prevents developers from including non-livable features like planter boxes, large air-conditioning ledges, or other “space-fillers” in the GFA. Previously, these features were often counted in the saleable area, inflating the PSF that buyers paid. Second, the rule eliminates strata void space from the GFA, which refers to the vertical space from floor to ceiling. In the past, double-height void spaces in high-ceiling units were included in GFA calculations, effectively charging buyers for unusable space. By removing these elements, the new rule aims to make floor plans more efficient and transparent, giving buyers better value for actual livable space.

Impact on New Launch Condo Prices: Why “Price Per Square Foot” Appears Higher

One noticeable effect of GFA harmonisation is its impact on the PSF pricing of new launch condos. As the new rule removes non-essential spaces from the GFA, the sellable area is now smaller and more focused on usable, livable space. Consequently, while the total cost of a condo unit may not have changed significantly, the PSF rate appears higher because it is now calculated based on a reduced area. In essence, buyers are now paying for quality over quantity, with every square foot they purchase being truly functional space.

This shift has led to some sticker shock among new buyers, as condos in harmonised developments seem more expensive on a PSF basis. However, this doesn’t necessarily mean that buyers are overpaying. With fewer non-functional spaces included in the unit area, the higher PSF is reflective of a more compact yet efficient layout, eliminating wasted space. The rule encourages developers to optimise floor plans for maximum usability, potentially leading to units that feel more spacious despite a smaller footprint on paper.

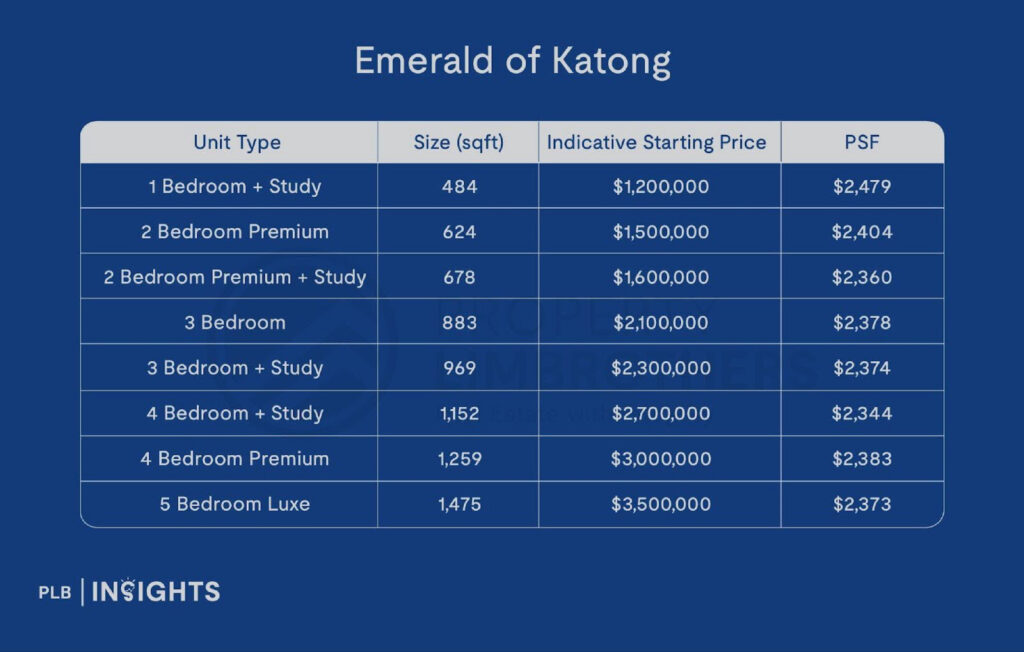

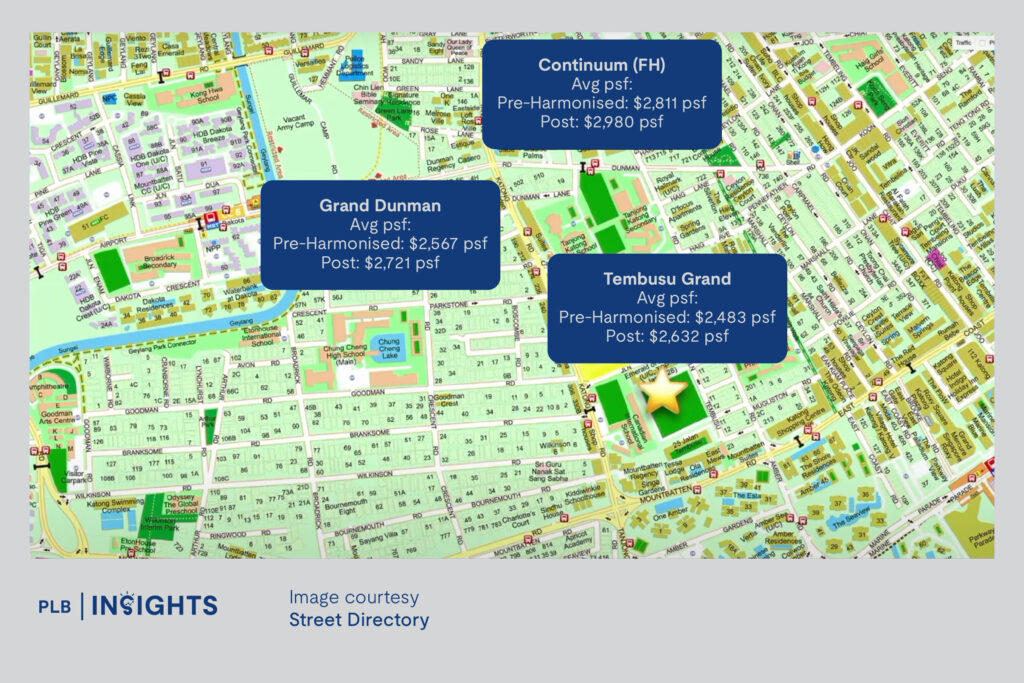

Using Emerald of Katong as a case study, you can see why it stands out and attracted over 10,000 visitors during its showflat preview, eventually selling 99% of its units at launch. Its post-harmonisation PSF, supposed to be higher than that of its pre-harmonisation peers, is priced between $2,3XX to $2,4XX – significantly lower than the other new launches in the area. Its direct competition sitting right next door, Tembusu Grand, is transacting at an average PSF of $2,483 ($2,632 if you account for a 6-8% increase to “post-harmonise” the project).

Since we are in a transitional phase where we are seeing a mix of both pre- and post-harmonisation projects, the PSF pricing on paper will not fully capture the nuances. The most important factors now will be the floor plans and entry quantum price, which directly impacts the buyers’ loan amount as well as future exit strategy.

How Does This Affect Developers & Buyers?

With the introduction of GFA harmonisation, condo developers are now incentivised to create smarter, more efficient layouts that maximise livable space. In the past, developers could rely on “extra” areas, such as air-con ledges and planter boxes, to inflate the unit’s GFA, which contributed to an inefficient use of space. Now, without these areas counting towards sellable square footage, developers must focus on creating layouts that provide real functionality and value to residents.

This change could lead to a revival of high-ceiling units as the void space above no longer counts against GFA. Buyers who favour units with high ceilings may find these options becoming more popular again, as they no longer have to pay for non-functional vertical space. Additionally, GFA harmonisation may prompt developers to reduce the prominence of balcony spaces, or to design them more thoughtfully as these areas can no longer artificially inflate the GFA.

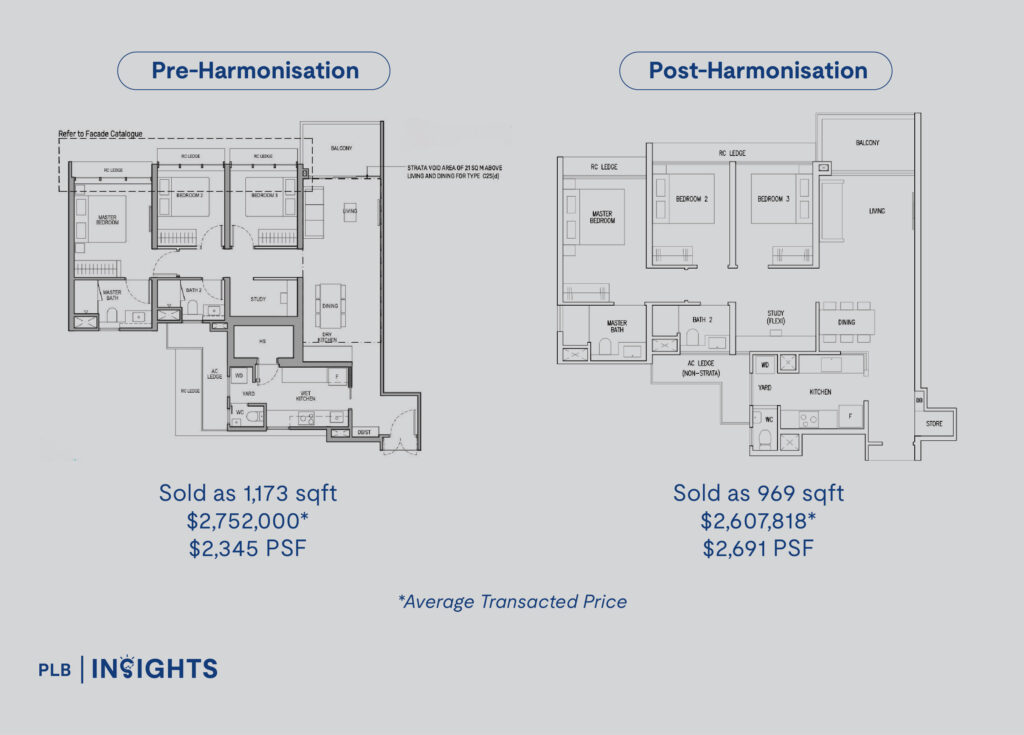

Using Emerald of Katong and the nearby Tembusu Grand as a case study again, you can see that the unit sizes are significantly different. The 3-Bedroom + Study units at the pre-harmonisation Tembusu Grand stood at 1,173 sqft compared to post-harmonisation Emerald of Katong’s 969 sqft. Although they look identical (with the exception of the size of the household shelter and kitchen), Emerald of Katong’s is priced cheaper than Tembusu Grand’s if you compare their quantum prices, despite a significantly higher PSF.

Is PSF Not Important Anymore Then?

PSF has long been a convenient metric for comparing property prices in Singapore. Its simplicity—comparing two properties of the same size and assuming the one with the lower PSF offers “better value”—makes it intuitive and widely used. However, as Singapore’s property market has evolved, this once-reliable benchmark has become increasingly disconnected from actual value. Today, relying too heavily on PSF can lead to misleading conclusions about a property’s worth.

In the past two years (since the introduction of GFA harmonisation), the resale market has seen a growing number of condominiums listed for sale. Some of these properties still use older data to calculate their specifications. For instance, a high-ceiling unit built in 2010 may still include strata void space in its marketed size, simply because it reflects the original specifications from when the unit was purchased. This isn’t necessarily deceptive—sellers might not be aware of how newer standards have changed.

When comparing pre- and post-harmonisation units, it’s important to recognise that pre-harmonisation properties might appear deceptively cheaper on a PSF basis. This discrepancy underscores why relying solely on PSF comparisons can lead to misunderstandings about a property’s actual value.

Instead, focus on the floor plan and quantum pricing to get a more accurate sense of a unit’s worth. The quantum price is what impacts critical aspects of your property purchase such as your loan eligibility, stamp duties, potential rental yield, and—if it’s an investment—the overall return on investment. This approach is particularly useful when evaluating unique layouts like dual-key units, which can further distort PSF metrics.

Relying too heavily on PSF can sometimes distract from these essential considerations. In high-pressure sales scenarios, attention is often steered toward the PSF figure to sway decisions, portraying one property as better value than another.

Closing Thoughts

While PSF has its uses, it’s important to remain grounded and keep the quantum price at the forefront of your decision-making. This ensures your financial planning is based on the true cost and returns of the property, not just a surface-level metric. By examining the property holistically, you can make better-informed decisions and avoid pitfalls associated with simplified price comparisons.

Let’s get in touch

Looking to navigate the property market, but confused by these new regulations? Let us help! From understanding quantum pricing to evaluating floor plans and maximising your investment returns, our team of seasoned real estate consultants provides data-driven insights and personalised advice to help you make confident property choices.

Contact us here today and take the first step toward a seamless and informed property journey!