Imagine you have a spare room at home that you’re not quite sure what to do with. Maybe it’s a place to store extra things, or you keep it ready for the occasional guest. Well, thanks to Airbnb, that room could be earning you passive income by hosting travellers from around the world—though, unfortunately, that’s not an option here in Singapore as the Urban Redevelopment Authority (URA) enforces strict regulations with hefty fines. Despite that, illegal short-term rentals continue to be listed on platforms like Airbnb in Singapore. As previously reported by CNA, these unauthorised stays persist even in 2024, reflecting an ongoing challenge for authorities as they attempt to regulate and curb short-term rentals in the city-state.

We have also previously talked about illegal subletting and provide tips for landlords which you can read about here. If you’re interested in learning more about short-term versus long-term rentals, you can also read about it here.

Airbnb has transformed the sharing economy by enabling short-term, peer-to-peer transactions for underutilised assets, effectively turning physical spaces into services. Another example of the sharing economy is Grab—a widely popular on-demand ride-hailing app in Singapore—that connects drivers with passengers seeking convenient transport.

However, unlike Grab, Airbnb operates under a stricter regulatory framework in Singapore. In February 2017, an amendment to the Planning Bill was passed, effectively banning short-term rentals (less than 3 months) in residential properties. The penalties for non-compliance are severe, with first-time offenders facing hefty fines of up to S$200,000 per charge. This legislation has reinforced strict limits on short-term stays, making it illegal for homeowners to rent out their spaces for brief periods through platforms like Airbnb.

Additionally, HDB enforces strict eligibility requirements for renting out flats: only Singapore citizens are permitted to lease their HDB units, and tenants must be Singapore citizens, permanent residents, or non-citizens holding valid passes, such as employment or student passes.

Why Ban Short-Term Rentals?

Housing is a key asset for the Singapore economy. According to the Department of Statistics Singapore, as of 2024, the Residential Building category contributes around 6.7% to Singapore’s GDP. Singapore currently has approximately 1,425,100 residential units. Among these, about 77.8% are public housing (HDB flats), while 17.2% are private condominiums, and the remaining 4.8% are landed properties.

One key reason is to protect the nature of residential areas. With short-term rentals, there tends to be a high turnover of temporary occupants, which can disrupt community life and the sense of community among long-term residents.

Security is another priority. The influx of short-term tenants may raise safety concerns, particularly in densely populated public housing areas. The government wants to maintain a stable, secure environment for permanent residents, which becomes more challenging with a constant flow of temporary visitors.

Additionally, this ban helps to support Singapore’s hospitality industry. Hotels and serviced apartments play a major role in the economy, and unrestricted short-term rentals could divert tourists away from these established accommodations. This would affect the hotel sector’s revenue. Furthermore, there are strict planning regulations. The URA mandates that private homes should not be repurposed without approval, as residential and commercial uses are regulated differently. To ensure these properties meet standards similar to those required of hotels, the authorities enforce rigorous guidelines.

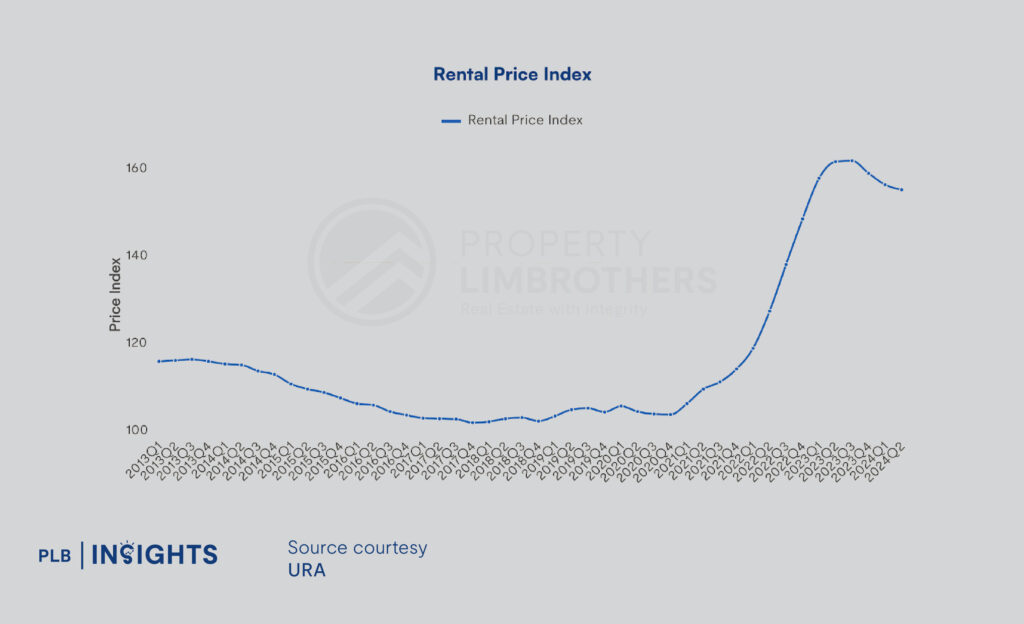

Short-Term Rental and Its Impact On Rents

An additional factor behind Singapore’s restriction on short-term rentals is the influence on rental rates. As seen from Figure 1, rents saw a substantial surge, rising by 29.7% in 2022 and 10.1% in 2023, before a slight dip of 2.7% in the first half of 2024. Despite this recent decrease, rental prices remain elevated compared to pre-pandemic levels. The speculative nature of short-term rentals can inflate demand and further strain the housing market, making it less affordable for long-term residents and exacerbating concerns over housing accessibility for locals.

Another phenomenon at play is “travel-induced inflation”, where prices spike due to a surge in demand from travellers, particularly around major events. An example is the F1 Singapore Grand Prix weekend, during which hotel prices skyrocketed. Fairmont Singapore’s Deluxe Marina Bay room was listed at $1,888 per night from September 20 to 22, compared to the usual rate of $500 to $700 per night. This substantial increase reflects how travel-induced demand allows hotels to charge premium rates as they accommodate the influx of visitors.

Allowing residential houses to be used for short-term rentals could similarly trigger travel-induced inflation within the local housing market. When homes are frequently rented out to travellers, especially during peak tourism periods, demand for these short-term rentals can surge, driving up prices. Over time, this can lead to a rise in overall rental rates as property owners adjust their pricing to capture this increased demand. This dynamic could ultimately make rental housing less affordable for local residents, especially in high-demand areas, potentially influencing the broader rental market and cause rental to be unaffordable in the long term.

Empirical Research Shows that Airbnb Drives Up Housing and Rental Prices

An empirical study on the effect of home-sharing on house prices and rents in the US by The Wharton School of the University of Pennsylvania revealed that Airbnb significantly influences both. The effect is particularly pronounced in areas with fewer owner-occupied homes, suggesting that non-owner-occupiers are more inclined to shift properties from long-term to short-term rentals. In zip codes with median owner-occupancy rates, a 1% rise in Airbnb listings corresponds to a 0.018% increase in rent and a 0.026% increase in property prices, reflecting how Airbnb can contribute to higher housing costs.

While the Wharton study specifically focuses on the US market, similar trends could have an even more pronounced impact in Singapore due to unique factors in the local housing landscape. If short-term rentals like Airbnb were allowed on a large scale, the effects on Singapore’s housing market could be more severe for several reasons:

- High Proportion of Public Housing

With over 80% of Singaporeans residing in HDB flats, which already have strict eligibility and rental rules, expanding short-term rentals could heavily concentrate on the private rental market. This shift would likely drive up rents in private housing areas due to increased competition for short-term rental options, especially in popular neighbourhoods.

- Limited Housing Supply

Singapore has a relatively small housing market compared to the US, with fewer available units and higher population density. Short-term rentals could further constrain this limited supply, exacerbating demand and driving up both rents and property prices more significantly than in larger, less densely populated markets.

- Impact on Rental Affordability

Given Singapore’s emphasis on housing affordability and stability, a surge in short-term rentals could put pressure on long-term rental affordability. In a densely populated city with high housing costs, even a small percentage shift towards short-term rentals could have a disproportionate impact on rental rates, affecting local residents who rely on the long-term rental market.

- Tourism Demand

As mentioned above, the travel-induced demand may push rental prices up significantly, especially during peak seasons.

In Conclusion

While Airbnb and similar short-term rental platforms have transformed the sharing economy and offer potential income opportunities for homeowners, the implications for Singapore are complex and challenging. The local housing market’s unique characteristics—such as a high proportion of public housing, limited supply, and stringent regulations—make the widespread adoption of short-term rentals problematic. Allowing these rentals could disrupt community stability, compromise security, and contribute to rising rental prices, making housing less affordable for locals.

Let’s Get In Touch

Our aim is to deliver valuable insights and practical information to empower your decision-making. Whether you’re a first-time homebuyer, a seasoned investor, or simply exploring your choices, our team of consultants is here to guide and support you steps of the way.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, ProperyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.