On 23 August 2024, US Federal Reserve (the Fed) Chair Jerome Powell said “the time has come” to cut interest rates, affirming expectations that the Fed would begin lowering them in September.

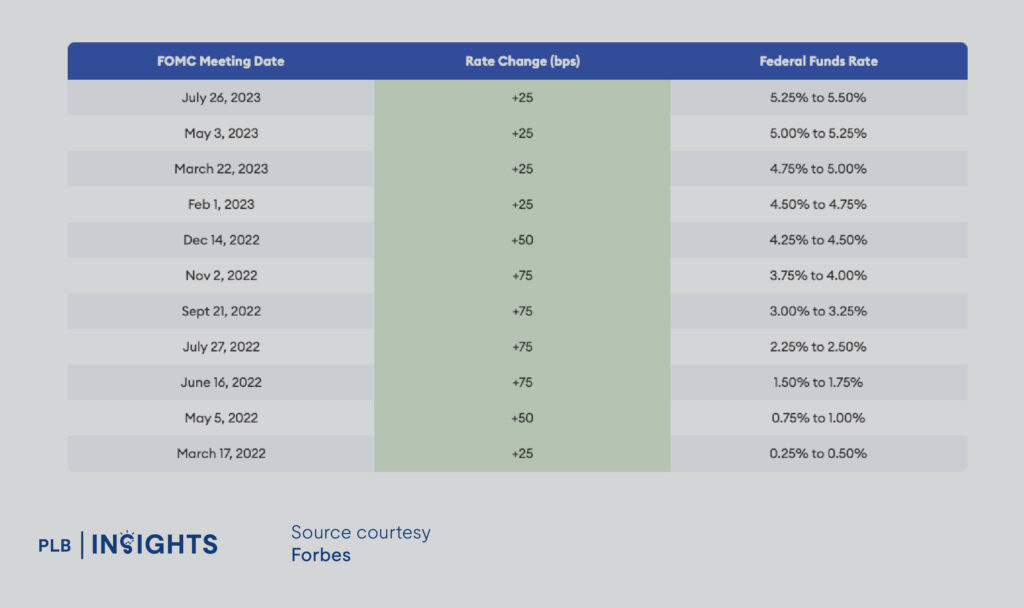

Since March 2022, the Fed has raised interest rates from nearly 0% to a range of 5.25% to 5.50%—the highest it has been in over 20 years. This has resulted in higher borrowing costs throughout the economy. Over the last year, the Fed has kept its benchmark interest rate unchanged to keep inflation in check despite the speculated “three cuts” announced in 2023.

As we explained the differences between HDB and Bank Loans in our previous article, it will be interesting to find out the impact of a potential September rate cut on bank loans and how it will affect homebuyers and owners.

The Fed Interest Rate Decisions and How It Affects Singapore’s Policy Decisions

The Fed changes the interest rate based on economic conditions. By adjusting rates, the Fed aims to fulfil its dual mandate of maintaining price stability and maximising employment.

Mechanism: If the economy overheats and inflation rises, the Fed increases interest rates. Conversely, if the economy weakens and unemployment is high, the Fed reduces rates.

Central banks in various countries, including the Monetary Authority of Singapore (MAS), have implemented policy tightening measures to curb inflation in the last two years. However, Singapore relies primarily on exchange rate policy (rather than interest rates) as its main monetary policy tool to manage inflation. Coupled with Singapore’s small and open capital market, its interest rates are largely influenced by global rates, particularly those set by the US.

Therefore, interest rate changes in Singapore have traditionally followed the movements of US interest rates, meaning that when the US rates rise or fall, Singapore’s interest rates and mortgage rates adjust in the same direction.

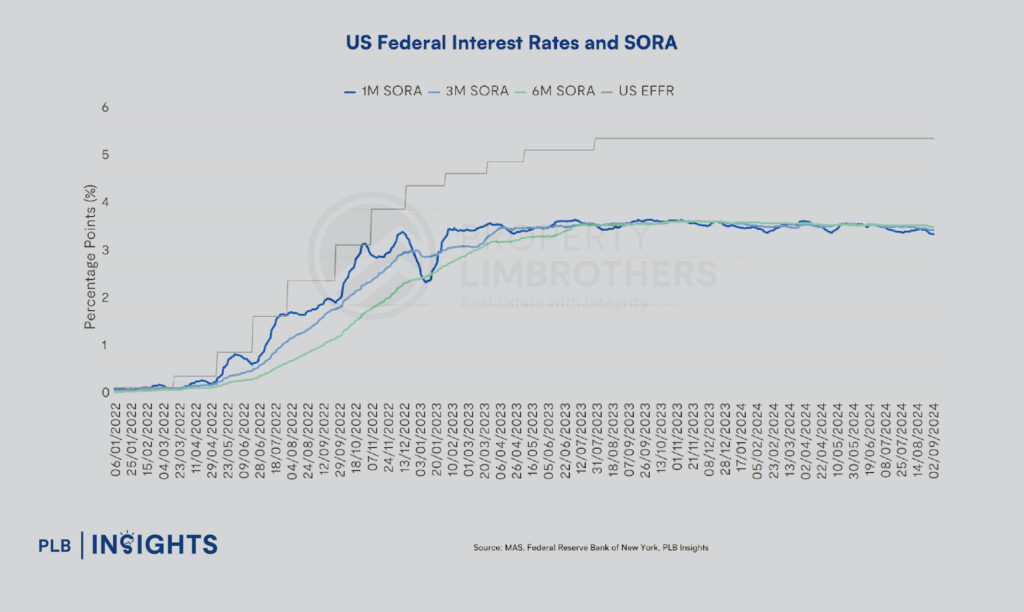

Since most floating rate packages in Singapore are pegged to the Singapore Overnight Rate Average (SORA), any downward shift in the US Fed interest rate results in a lower SORA.

Historical US Fed Rate Hikes Since 2022

Over the last 18 months, the Fed increased the interest rate by more than five percentage points and this has helped reduce the red-hot inflation rates that were eating into the purchasing power of individuals.

Figure 1 above shows the SORA (1-month, 3-month and 6-month compounded rates) and the US Effective Federal Funds Rate (EFFR) (essentially the effective median interest rate of overnight federal funds transactions during the previous business day) from January 2022 to September 2024. From Figure 1, it is evident that the EFFR hike influences SORA in an upward direction.

Just last month, US employment data suggested that the level of unemployment is already higher than the 4% level Fed officials pencilled in for 2024 in their updated economic projections in June, and the 4.2% policymakers projected for the end of 2025. On the other hand, data suggests risks to the inflation mandate have been reduced.

Therefore, the Fed is anticipated to lower interest rates in 2024, mainly due to indications that inflation is easing and to spur economic growth. Following a series of aggressive rate increases aimed at controlling inflation, there is a rising belief that inflationary pressures are subsiding. Cutting interest rates would be a strategic move to avoid an excessive slowdown in the economy.

Additionally, any potential rate cuts would mean that the SORA is likely to move downwards, in tandem with US interest rates.

Essential Insights for Singaporean Homebuyers and Owners

1. Impact on Mortgage Rates and Borrowing Costs

Lower Monthly Mortgage Payments

A decrease in US interest rates and SORA would result in more affordable borrowing. Lower interest rates will reduce the cost of mortgages provided by local banks, easing the financial burden for both existing and new homeowners.

Depending on the type of packages borrowers have opted for, a reduction in interest rates would translate into a reduction in mortgage interest rates for homebuyers and owners. For instance, according to data from DBS bank, 3M SORA fell from 3.701% in January 2024 to 3.569% in September 2024. Fixed-rate mortgage rates have also dipped, with two-year fixed-rate mortgage packages available at lower than 3%.

Opportunity to Capitalise on Lower Interest Rates Trend

Mortgage rates cut means cheaper borrowing, making homes more affordable to homebuyers. In such an environment, it is also an opportunity for homeowners to capitalise on the lower interest rates to refinance their existing mortgage.

For those who wish to tap on the opportunity to refinance their loans, do take note of the fees and charges associated with refinancing. For example, DBS charges 1.50% of the outstanding loan amount, 0.75% of the undisbursed loan amount and a processing fee of S$800 for refinancing with the same financial institution. So it is crucial to conduct careful financial planning.

2. Impact on Demand

Increased Transactions and Demand

Lower borrowing costs can boost demand in the property market by making borrowing cheaper, leading to increased buying activity. This rise in transaction volume and demand can drive up property valuations and prices. However, this could also serve as a double-edged sword as higher demand leading to increased housing prices means buyers would need to spend more on purchasing a home, resulting in larger mortgage loans that could potentially eat into purchasing power.

Deciding Between Fixed and Floating Mortgage Rates in a Volatile Rate Market

In the current fluctuating interest rate environment, homebuyers are faced with the important decision of selecting between fixed and floating mortgage rates.

Fixed rates, currently appealing at below 3%—a drop from last year’s 4%—provide certainty and stability, making them ideal for those who value budget certainty amid potentially declining rates. This certainty is particularly advantageous during a lower interest rate environment, enabling homeowners to secure the opportunity of lower costs without the risk of sudden rate hikes in the future.

Conversely, floating rates offer flexibility, adjusting in line with macroeconomic movement. This option could be beneficial in a declining interest rate environment too, as it allows borrowers to take advantage of any further rate reductions. However, it also carries the risk of sudden rates rising, which can complicate financial planning and lead to higher borrowing costs.

Final Thoughts

The Fed’s interest rate decisions impact the global economy, including Singapore’s property market. Staying informed with global economic conditions and understanding personal financial goals are crucial for market participants. While we await further updates, a potential rate cut could benefit new homebuyers and those considering to refinance their housing loans, as lower SORA rates would make loans cheaper.

We recognise that it may be complex to navigate the property market amid a fluctuating interest rate environment. Our goal is to provide you with up-to-date information to support informed decision-making. Whether you are a first-time homebuyer, an experienced investor, or just considering your options, our team of experienced consultants is ready to assist you at every stage.