Additional Buyer Stamp Duty (ABSD), the bane of any enthusiastic residential real estate market participant in Singapore. Why can’t we just buy more properties if we can afford them? Well, the answer is simple: it keeps the market regulated and lowers speculative purchases. Serving the same function is the Seller’s Stamp Duty (SSD). Both these duties, unlike Buyer’s Stamp Duty (BSD), function as deterrent costs to a quick turnaround of a sale & purchase.

ABSD is applicable to a few groups of participants. Namely, Singapore Citizens purchasing their second property, Singaporean Permanent Residents (SPR), Foreigners, Entities, and Housing Developers. The loophole which has been highlighted in question is mainly applicable to Singaporean participants. Now, do not confuse the “99-to-1” ABSD loophole with decoupling if you currently own a property with another individual in a 99 to 1 tenancy-in-common holding manner. One is perfectly legal and the other is a rather questionable situation.

In this article, we will explain the difference between decoupling and the ABSD loophole that IRAS is clamping down on.

The Legal Method

For the slightly more informed, decoupling should not be a novel term to you. It is a planned property strategy to allow participants to expand their property portfolios by selling a portion of their share. This is to release their name and purchase another property without incurring ABSD, as they will no longer have a residential property count after the sale.

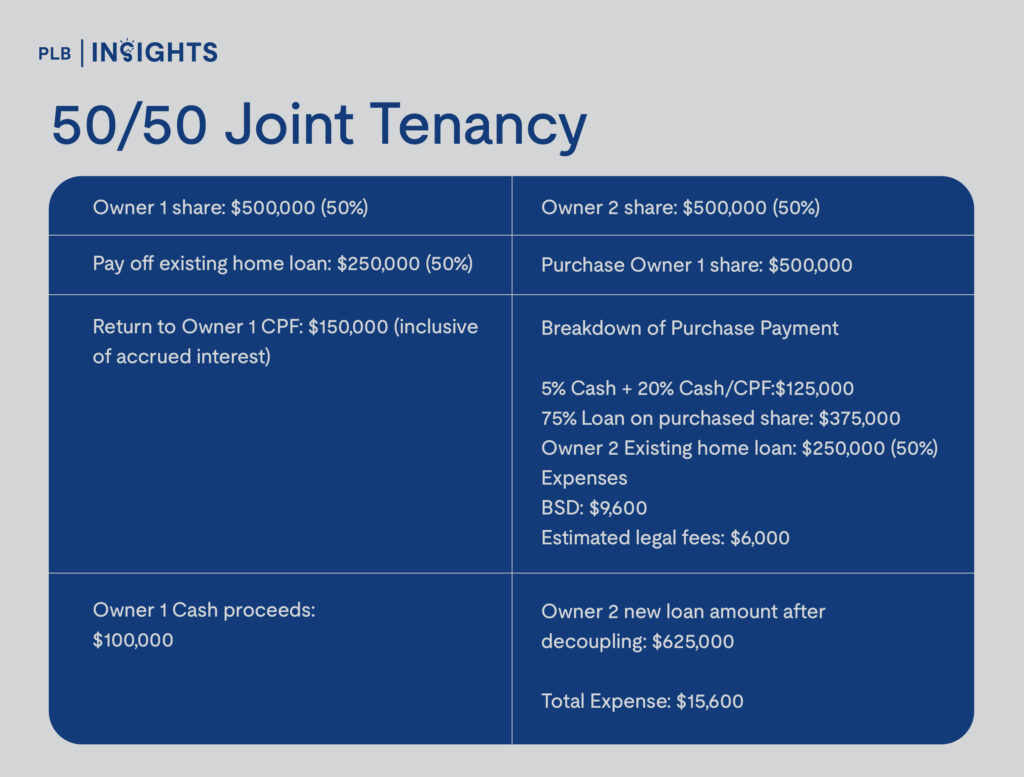

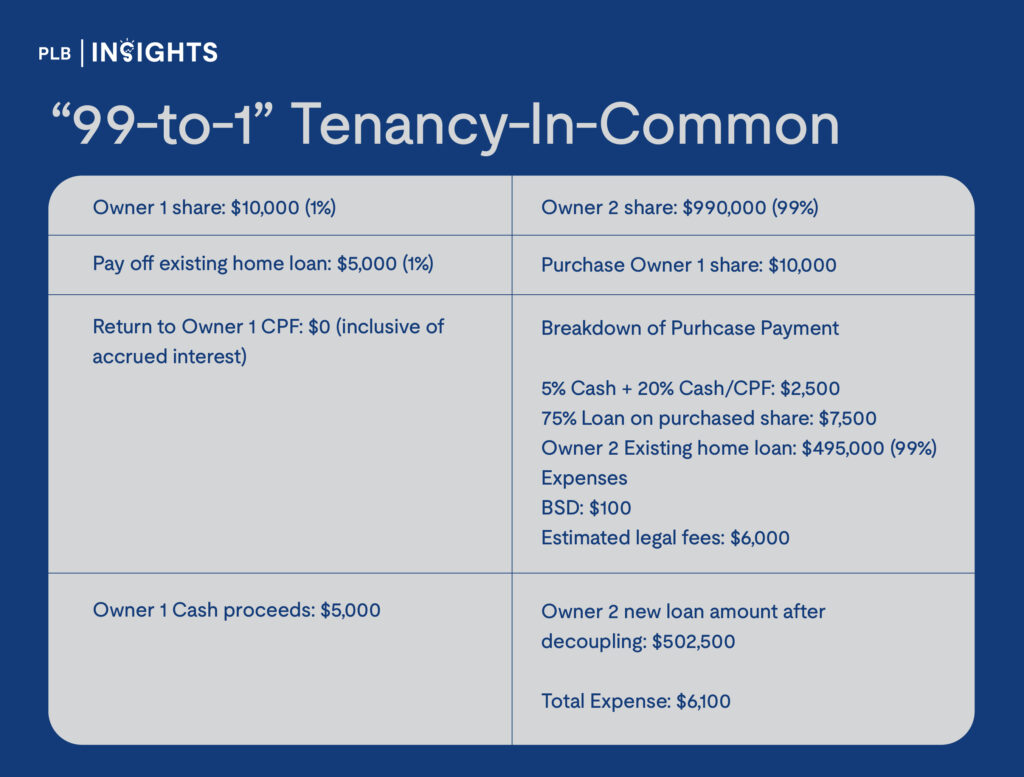

In order to facilitate this method in a more economical manner, the buyers of a property will have to opt for a tenancy-in-common agreement during the purchase. This will allow them to decide the percentage of shares each party will hold. In a joint tenancy, all buyers will have an equal percentage share of the property. So in most cases, a couple, it would be a 50/50 share. Whereas a tenancy-in-common will allow you a 99% to 1% share. This is a more economical method when it comes to selling your share (after clearing SSD Period) to the co-owner of the property. Take this for example:

Assuming Valuation of Property at time of Sale/Decoupling: $1,000,000

Existing home loan balance: $500,000

From the simple example above, some key benefits you may already have noticed is the lower mortgage loan for the remaining owner of the property and lower expenses incurred due to a lower stamp duty on the purchased share. This is a potential route for portfolio expansion assuming that in the foreseeable future, one party will be financially able to purchase another property on their own name and the remaining owner of the existing property is eligible to sustain the mortgage loan purely on their own financial standing.

The typical timeline of planning such a route is foreseeing at least 3 years ahead at the point of purchase in order to clear the SSD period. This may seem like a slightly complicated process, so do speak to a professional before proceeding with this method.

The Questionable Method

Now, what if there is an opportunity that you happen to chance upon and you are unable to offload your existing property and yet not want to let go of this opportunity to expand your property portfolio? There are various reasons why some participants may explore the questionable method of the “99-to-1” loophole. But the general intention is usually to help increase the loan capacity of the main purchaser.

Similar to the decoupling method, the property buyers will enter into a tenancy-in-common holding but the gist of the loophole lies in the timing in which the second buyer is added into the purchase process. In a standard purchase, both buyers will be named in the Option To Purchase (OTP) and exercise the OTP together. But in this scenario if one of the buyers has an existing property count then they would need to pay ABSD on the full purchase price/market value (whichever is higher) of the unit in consideration.

Clearly, this is not a very economical option. Assuming the second residential property is $1,000,000, that would mean an ABSD fee of $200,000 (this has to be in cold hard cash). Hence, the creative method of lowering the ABSD cost became more apparent with the “99-to-1” loophole.

In general, the exploitation of this loophole would be adding in an additional buyer into the purchase during the Completion Period. To recap, there are 2 main timeframes in a property purchase: the Option Period and Completion Period.

The first buyer will proceed with the purchase and exercise the OTP during the Option Period. This will allow them to avoid paying any ABSD as they do not have any property count. During the Completion Period, 1% of the ownership share will be sold to the second buyer to increase the loan capacity and help finance the property purchase. With this process, the ABSD applicable will be reduced to $20,000 instead of the aforementioned $200,000. This creates a questionable scenario where the first buyer may not be able to afford property purchase, if not for the addition of the second buyer and increased loan capacity. It would seem as if they were supposedly purchasing the property together, but in order to avoid the higher ABSD cost, they adopted the creative loophole. This action of avoiding the higher ABSD cost is seen as intentionally avoiding tax.

Repercussions to the Market

At the time of writing, it has been reported that about 0.5% of private properties transacted in the period of 2018 to 2021 involved the 99-to-1 method, or similar purchase agreements. That works out to be about 479 units amongst 95,755 transactions (excluding executive condominiums). This represented a small fraction of transactions, but the trend grew steadily, leading IRAS to conduct further investigations. At the moment, there is a reward of up to $100,000 for whistleblowers who call out private property buyers who exploited the loophole.

There is unlikely any foreseeable impact to the broader market as there is only a smaller number of such transactions. The penalty for tax avoidance would be to recover the rightful amount of stamp duty and impose a 50% surcharge on the additional duty payable. This will possibly erase any potential gains from such property investments.

Final Thoughts

Property investment remains as a lucrative and popular method of wealth preservation and expansion. However, controlling the high costs of owning multiple properties is a regulatory measure aimed at maintaining stability and attractiveness in the real estate market.

Among the two methods discussed in this article, the decoupling method is a strategic real estate investment approach that requires a dedicated timeframe to achieve results. Although any immediate opportunities may be missed, it is a more secure option than adopting questionable and creative methods. PropertyLimBrothers and its consultants do not encourage or promote methods which put clients at risk of any breaches of law.

The intricacies of real estate investment and planning can be overwhelming if you do not have the right information. Always consult a professional to avoid falling into any pitfalls or making the wrong decisions. Contact any of our consultants for a more comprehensive understanding to guide your journey.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.