Everyone has been watching the results of the first two private condominium launches of the year – namely Hillhaven and The Arcady. The sales at both projects are a promising start to the new year, and the market can anticipate an improvement in uptake as buyers gradually re-enter the market as mortgage interest rates are gradually lowered. In comparison to the likes of J’den and Watten House, the first two launches of 2024 pale in comparison to the robust interest for the last two launches of 2023. While buying sentiment remains strong, prospective buyers are taking their time to assess the market and explore their options, indicating a price-conscious and selective approach to purchasing property. Let’s take a deeper look at how these two projects fared and what it could mean for the year ahead.

Hillhaven

For Hillhaven, developers sold 59 out of 179 units in the first phase of launch for Hillhaven, constituting 17% of total units. The average price comes up to $2,066 psf and of the available units launched, all 11 of the two-bedroom-and-study units and 25 out of 38 two-bedroom units have been sold. According to a press release by Far East on Saturday, all 59 buyers are Singaporeans and permanent residents, and those in the age range of 31 to 50 constituting approximately 70% of the buyers. The project is a collaboration between Far East Organisation and Sekisui House Ltd, with a majority of the sold units being two and three bedroom units. Hillhaven offers an appealing price point in comparison to the average transacted price of $2,150 per square foot for new 99-year leasehold non-landed private homes in the Outside Central Region that were sold in 2023.

The Arcady

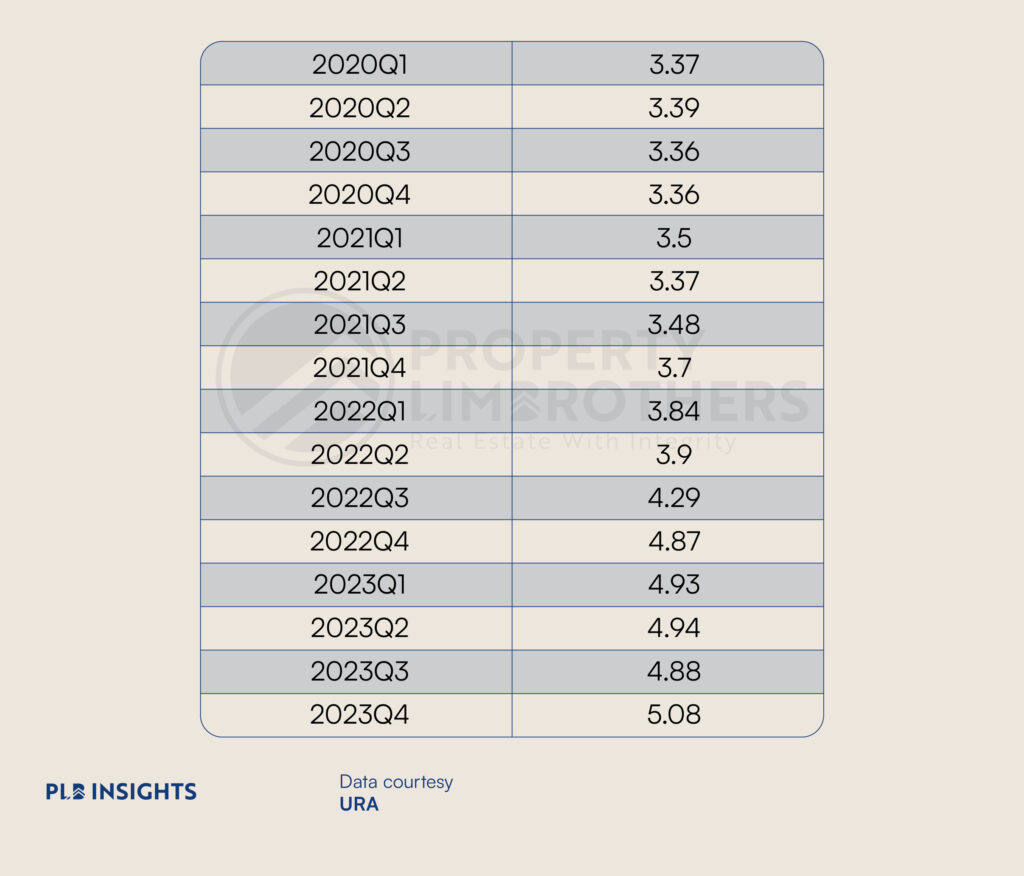

Looking at The Arcady which was developed by KSH holding, SLB Developments and H10 Holdings, 51 out of 172 units of the freehold’s launch were snapped up. In a reverse trend compared to Hillhaven, this project’s one-bedroom and study units proved to be popular and were all sold along with 25 of 38 two-bedroom units. In particular, smaller family sizes have driven a preference for the two-bedroom units at The Arcady at Boon Keng. Within 1km of The Arcady includes several primary schools such as Hong Wen School, Bendemeer Primary School and Farrer Park Primary School. Rental prices in District 12 have been on a steady upward trend, increasing from $3.34 psf to $5.08 psf between 2020 to the end of 2023. Among the projects being launched this year, only 11% of the expected 11,000 units will be freehold. The project presents an appealing option for HDB upgraders seeking freehold developments in a thriving and strategically located neighborhood near the city.

Why The Slow Start?

2023 saw the lowest number of private home transactions since 2008, hence the same sentiments could have trickled down into the first few months of 2024. Along with the increased cost of borrowing as interest rates reached a high, dampening the motivation for buyers to make quicker purchase decisions. In the year 2023, a total of 6,452 newly constructed private residences, excluding executive condominiums, were purchased. This figure represents the lowest number of sales since 2008, when only 4,264 units were transacted.

The slow start of the two real estate projects in 2024 in Singapore could be attributed to a combination of factors. Firstly, if the inflation rate is high, developers may face increased construction costs, which they might pass on to buyers, leading to higher property prices. This inflation-induced price hike could potentially deter prospective buyers, particularly those who are price-conscious or have limited purchasing power.

Secondly, if inflation prompts the Monetary Authority of Singapore to raise interest rates to control price growth, borrowing costs for mortgages may increase. As a result, potential homebuyers may find it less affordable to finance their property purchases, leading to subdued demand in the real estate market. These dual effects of inflation on construction costs and borrowing costs could be contributing to the sluggish performance of the two real estate projects in Singapore. With Singaporeans being more conscious of increasing interest rates and inflation, household debt has been decreasing, alluding to a slowdown in property transactions.

We can anticipate that transactions will pick up in February, after the Lunar New Year. While the sluggish start may seem discouraging, buyers can look forward to 30 other launches slated to be revealed this year. With so much competition in the market, developers may price more competitively which benefits homeowners this year.

Closing Thoughts

The initial condominium launches in 2024 reflect a sluggish start amidst cautious buyer sentiment and a year-end lull in activity. Prospective buyers, remaining selective and price-conscious, are taking their time to assess the market and review their options, suggesting a prudent approach to property acquisition in uncertain times. The launch of freehold projects like The Arcady at Boon Keng presents opportunities for buyers, given the limited availability of freehold units and rising demand for such properties, particularly in desirable locations. With an abundance of new residential projects expected in 2024, competition among developers may lead to more moderate price growth, ultimately benefiting homebuyers in the long run. If you are interested in starting your property journey this year, do not hesitate to contact us and our consultants will be happy to help. See you in the next one.