In December, the Singapore property market witnessed a stark decline in new private home sales, marking the lowest levels since January 2009, reminiscent of the impact of the 2008 global financial crisis. Buyers exercised caution amidst rising macroeconomic uncertainty and increased borrowing costs due to high interest rates, while developers opted to withhold new launches during the customary year-end lull.

December Sales Downturn

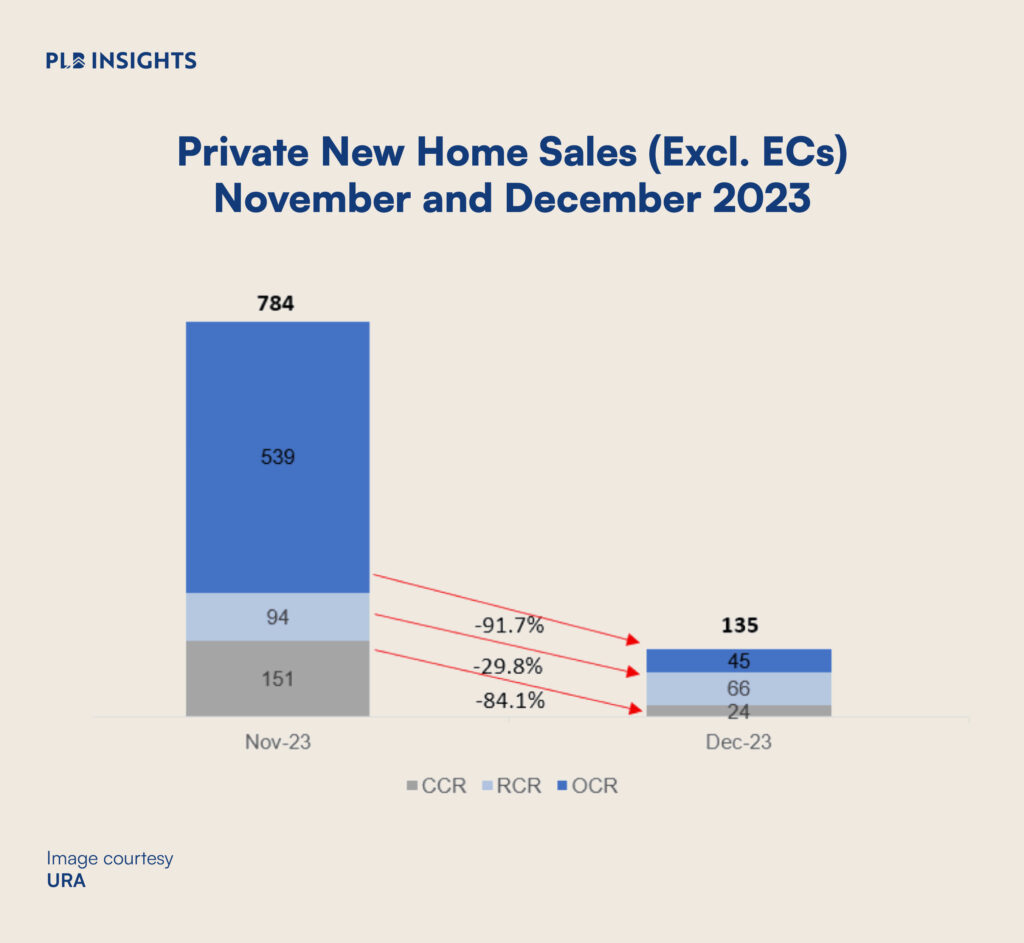

The final month of 2023 saw a staggering 82.8% drop in developers’ sales month-on-month from November, excluding executive condominiums (EC), with a meagre 135 units sold, representing the lowest monthly sales tally since January 2009. Year-on-year figures painted a gloomy picture, with sales plummeting by 20.6% from the 170 units recorded in December 2022. When including ECs, the overall new home sales figure witnessed an 81% decrease, totalling only 152 units.

Throughout 2023, the average take-up rate of new projects featuring at least 100 units in the first month of launch decelerated to 55%, down from the more robust 72% observed in 2022. Notably, the total new home sales (excluding ECs) for the entire year fell to 6,452 units, marking the lowest annual sales since the global financial crisis of 2008.

Developers’ Strategies and Prospects

December reflected a cautious stance from developers, as only 36 new units were introduced to the market, reaching a six-month low. Looking ahead to 2024, approximately 40 residential projects are scheduled for launch. However, headwinds including weakened demand from HDB upgraders, investor concerns, and the hesitancy of foreign buyers due to heightened ABSD rates may not cause all 40 to launch in the year.

How Are The Different Regions Doing?

The Rest of Central Region (RCR) took the lead in December, with developers selling 66 new units, a notable decrease from the 94 units sold the previous month. This marked a nearly 30% month-on-month decline, the smallest among the three sub-markets. Highlight projects in the RCR include The Continuum and The Landmark, selling 17 and 13 units, respectively, at median prices of $2,775 PSF and $2,853 PSF. Other RCR projects, namely Blossoms by the Park, Grand Dunman, and Pinetree Hill, each transacted 6 units during the month.

In the Outside Central Region (OCR), developers experienced a sharp decline, selling 45 new units in December—down by a significant 92% from the 539 units transacted in November. Notable projects like J’den in Jurong East and Hillock Green in Lentor contributed substantially to November’s sales. Top-performing OCR projects in December included The Myst, selling 9 units at a median price of $2,182 PSF, Lentor Modern with 8 units at $2,119 PSF, and J’den with 7 units at a median price of $2,577 PSF.

Core Central Region (CCR) new home sales also took a hit, dropping by 84% month-on-month from 151 units in November to 24 units in December. The launch of Watten House in November set a high base for comparison. December’s monthly sales in the CCR, at 24 units, represent the lowest since December 2018 when 16 units were sold. Leading CCR projects in December 2023 were Midtown Modern and Watten House, each selling 6 units at median prices of $2,882 PSF and $3,258 PSF, respectively.

In the Executive Condominium (EC) market, developers sold 17 new units in December, a slight uptick from the 16 units sold in the previous month. North Gaia emerged as the most popular EC project, selling 9 units at a median price of $1,298 PSF, followed by Altura, which sold 6 units at a median price of $1,490 PSF. According to URA data, only 288 unsold new EC units are currently on the market. Notably, the 512-unit Lumina Grand EC in Bukit Batok is set to be launched for sale on January 27.

Developers introduced a total of 36 new units (excluding EC) for sale in December, marking a substantial decrease from the 970 units released in the previous month. This represents the lowest number of new units launched since June 2023 when 31 units were introduced to the market.

Outlook for 2024

An estimated 11,000 new private homes may enter the market in the upcoming year, contingent on developers’ assessments, sales plans, and strategies. Anticipations include a more nuanced pricing strategy from developers. However, major price corrections are not foreseen due to factors such as elevated land and development costs, a low unemployment rate, ample market liquidity, and potential economic improvement in the second half of 2024.

There is a potential uptick in new home sales in January 2024, driven by the launch of projects like The Arcady at Boon Keng, Hillhaven in Hillview Rise, and Lumina Grand EC in Bukit Batok. These developments are expected to garner attention due to their comparatively more affordable pricing and potential market demand.

Closing Thoughts

As Singapore’s property market navigates through challenging terrain marked by cautious buyers, limited launches, and economic uncertainties, industry stakeholders closely monitor developments in 2024. The market’s resilience, coupled with strategic launches and pricing considerations, will play a pivotal role in shaping the property landscape in the months ahead.

If you are in the market for a property or are considering a move and are unsure about how to navigate the coming season, do look out for our upcoming webinars or reach out to us here for a tailored consultation with our team.