When it comes to purchasing a real estate property, you have a lot of factors to consider. You have to consider the location you want to live in, nearby activities based on how accessible your property is, and how this property can grow alongside you as you change throughout your life. But a major consideration that can sometimes get lost in the emotional excitement of buying a property is the potential profit you can generate when it comes time to sell your property.

Not only does real estate have an incredibly high “usability quotient” as our co-founder Melvin Lim talks about here, real estate is also a powerful investment vehicle. The ability to live in a property while it appreciates in price is a powerful combination, and it’s the reason why your financial portfolio ought to include real estate.

At PropertyLimBrothers we are passionate about the upward mobility and security that real estate provides to society. This passion is what inspires us to help people access and benefit from the Singapore real estate market.

In this article we want to focus on the return on investment, or ROI, from sales of real estate properties. We’re going to share how to calculate your return on investment from your property, and share some of the expertise we’ve learned along the way to make sure you generate as much value as possible from your property. Let’s get started with how to calculate ROI and find out if you made a profit from selling your property!

3 Core Concepts You Need to Know to Make a Profit On Your Property

First and foremost, we want to start off with a quick walkthrough of the terms and concepts involved in purchasing real estate to inform the discussion of ROI on your property. Let’s walk through the steps of purchasing a S$2,000,000 property in Singapore so we know the costs and benefits of the entire process, and can ultimately calculate our return on investment when it comes time to sell our property.

Since most buyers typically do not have enough cash available to purchase the property at full price, it is extremely common for future property buyers to finance the purchase of the property with a loan from a bank. Buyers will put down a certain percentage of the price of the property, at least 25% of the property value inclusive of CPF and cash, and borrow the rest from a bank. This loan, or leverage, is called a mortgage. And this leverage is one of the most exciting parts of real estate as an asset class because it allows a buyer to purchase and control an asset without having to come up with the full amount to buy it. In addition to controlling the asset, the buyer can benefit from the appreciation of the price of the property as a whole. The more you can borrow against a property, the more you can benefit from the appreciation of a large number without having to invest more of your capital. Our co-founder dives into the topic of capital appreciation here.

On the S$2,000,000 asset, let’s imagine someone who put down 25% of the property value as a down payment, or S$500,000. The remaining S$1,500,000 is financed by the bank. Every month the property buyer will pay the mortgage to the bank. This mortgage payment is made up of interest payments to the bank, and repayment of the principal. The repayment of the principal is you gaining ownership in the property, or equity. With every payment you make to the bank, you are slowly building more equity while the bank is losing equity in the property.

Some of the Well-Known (and Hidden) Costs of Your Property

However, with every transaction in real estate, there are additional costs you need to factor in with every purchase. These costs do add up over time and when you’re making a large purchase and investment into a property, do make sure you take these into account. Let’s explore some of the taxes and maintenance costs a property owner is responsible for in Singapore.

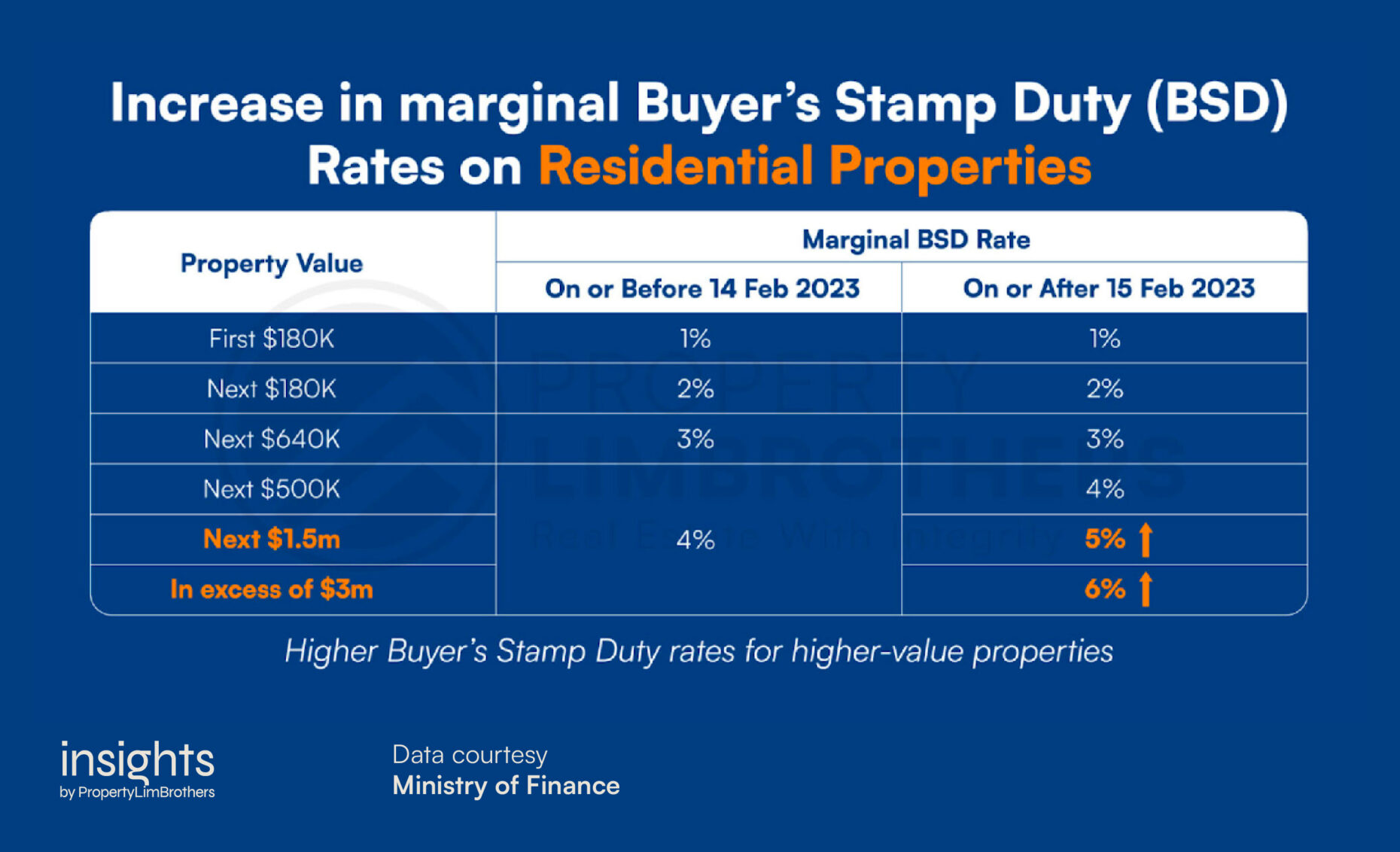

One of the largest costs a property buyer must pay when purchasing a residential property is the buyer’s stamp duty (BSD). Recent changes to the BSD in 2023 increased the BSD rate for higher-value properties, making it more expensive for individuals purchasing residential property. Here’s a table published from the Inland Revenue Authority of Singapore (IRAS) outlining the taxes payable to the government:

As you can see, the BSD is a progressive tax rather than a flat tax, which adds up to a significant cost for any property buyer to pay when purchasing a property. It’s a cost the buyer will need to come up with, aside from the money they have already set aside for a down payment. Even though we don’t want this cost to necessarily scare us off from purchasing a property, it is certainly something we need to be aware of when purchasing the property.

The next tax to consider is property tax. When you own your own property in Singapore you are now required to pay an annual tax based on the “Annual Value” of your property. This Annual Value is the appraised amount it would cost someone to rent your property, without furniture or maintenance, based on comparable prices nearby. Let’s assume your S$2,000,000 property has an annual value of S$60,000. You live in the property, so your property taxes are lower as an owner-occupied property. On the S$60,000 annual value, you now owe S$2,180 in annual property taxes. While that works out to less than S$200 per month on average, it’s still another cost you need to be aware of as a property owner.

The Tax You Owe When it Comes Time to Sell

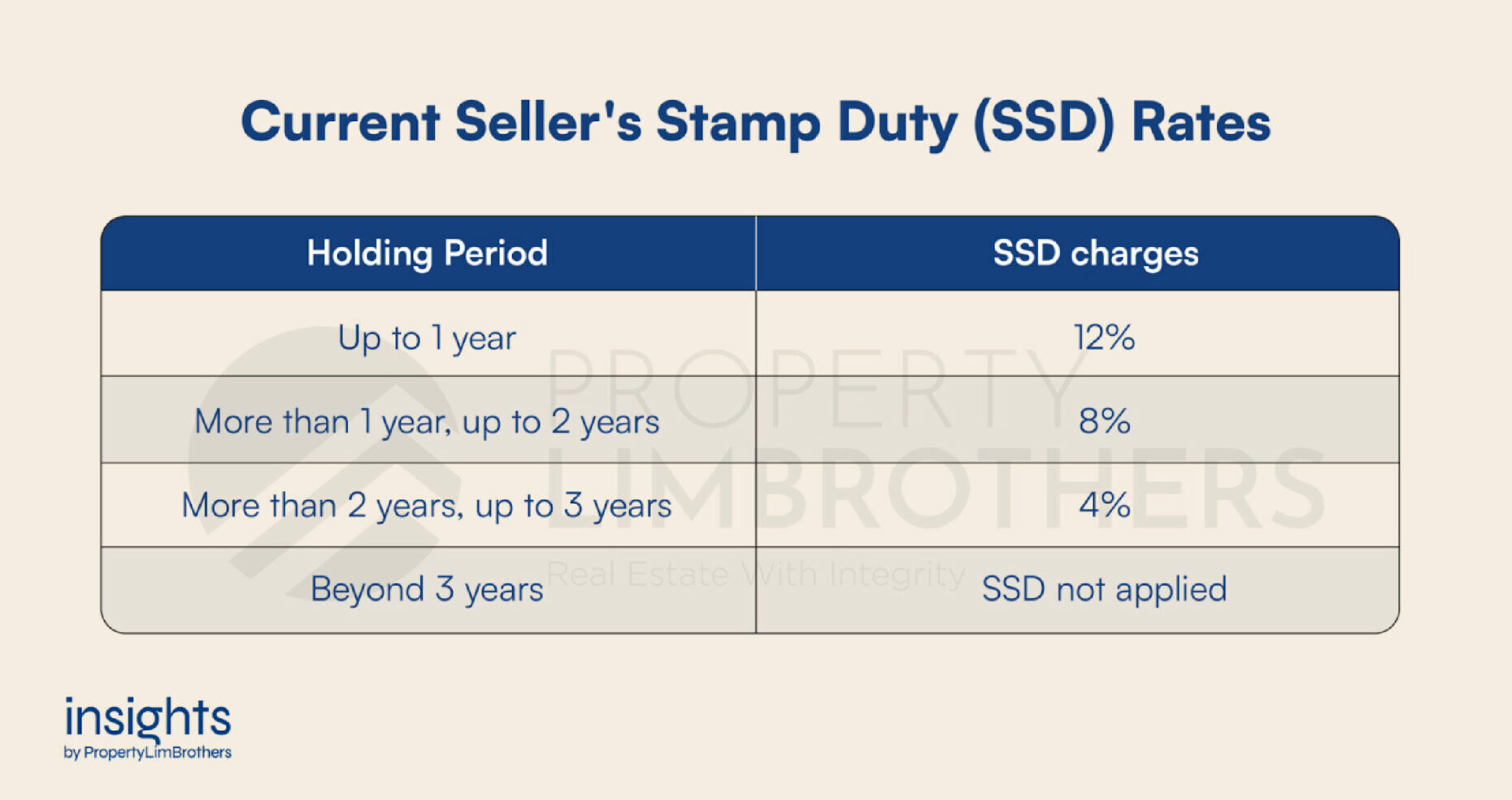

An additional cost to consider when calculating the real or potential future return on investment is the seller’s stamp duty. Seller’s stamp duty (SSD) applies to the sale of residential properties held under a certain number of years.

We always advise our clients to view their property purchase as an illiquid investment for at least the first 3 years of ownership. The reason is the seller owes the following amounts of the sale price to the IRAS, if they sell the property before the end of the third year from buying the property: 12% of the sale price if sold within the first year, 8% if sold during the second year, and 4% if sold during the third year.

Monthly Expenses Most People Forget to Calculate

Another large cost you will face every month as a property owner is maintenance and utility bills. Properties are beautiful investments, but they definitely require upkeep and work to keep them looking sharp. Whether that’s replacing appliances, repainting the property, or fixing any damage throughout the house, be aware these costs will pop up during your ownership of the property. Let’s assume our S$2,000,000 property costs S$1,000 per month, or S$12,000 per year, for utilities and the average annual maintenance cost upkeep.

You will also be expected to pay broker’s commissions, attorney fees, appraiser fees, insurance fees, and the fees for anyone else involved in the transaction. Since a lot of people are involved in the transaction, that means a lot of people are going to charge you.

Running the Numbers on Your Property…and Calculating Your Profit!

For a S$2,000,000 property, assuming the property was owned for 5 years, the seller does not owe the SSD. Which is great news for helping boost the ROI from your property sale.

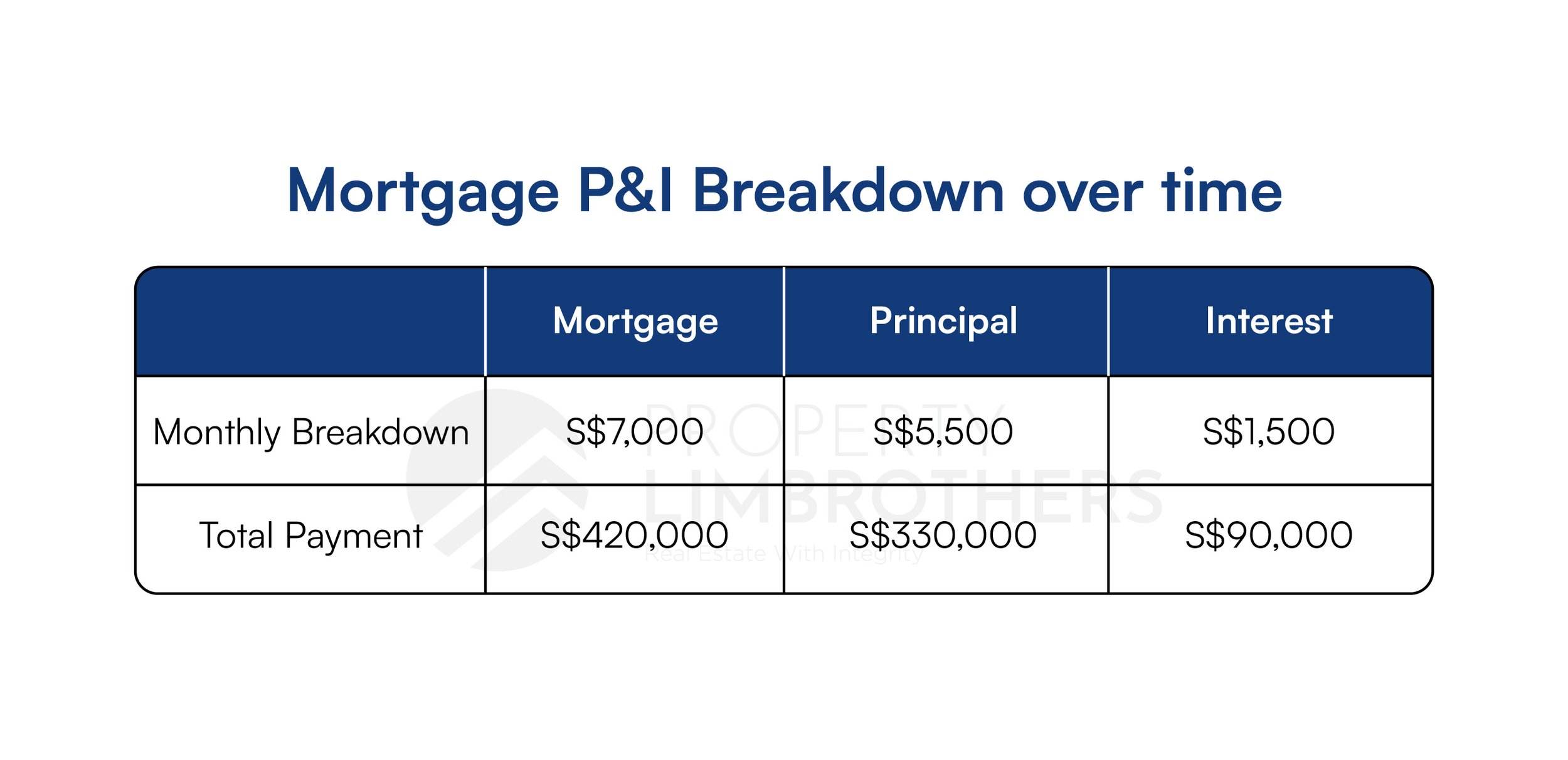

Now let’s consider the mortgage payments the property buyer made to the bank over time. For round numbers, let’s assume the S$1,500,000 mortgage was S$7000 per month, or S$84,000 per year. S$1,500 per month was paid in interest to the bank, and the other S$5,500 went towards building your equity in the property.

So that’s S$18,000 per year in interest, and S$66,000 per year in principal repayment. This principal repayment means even though S$5,500 of your money per month is going to the bank, it’s being credited in your favour to pay down the money they lent you.

Let’s assume this mortgage has a 75% LTV ratio, 3.81% interest rate over 30 years. Over the course of 5 years you paid S$420,000 to the bank. S$90,000 of that money was interest owed to the bank. The remaining S$330,000 went towards the principal, so your S$1,500,000 loan was reduced to S$1,170,000.

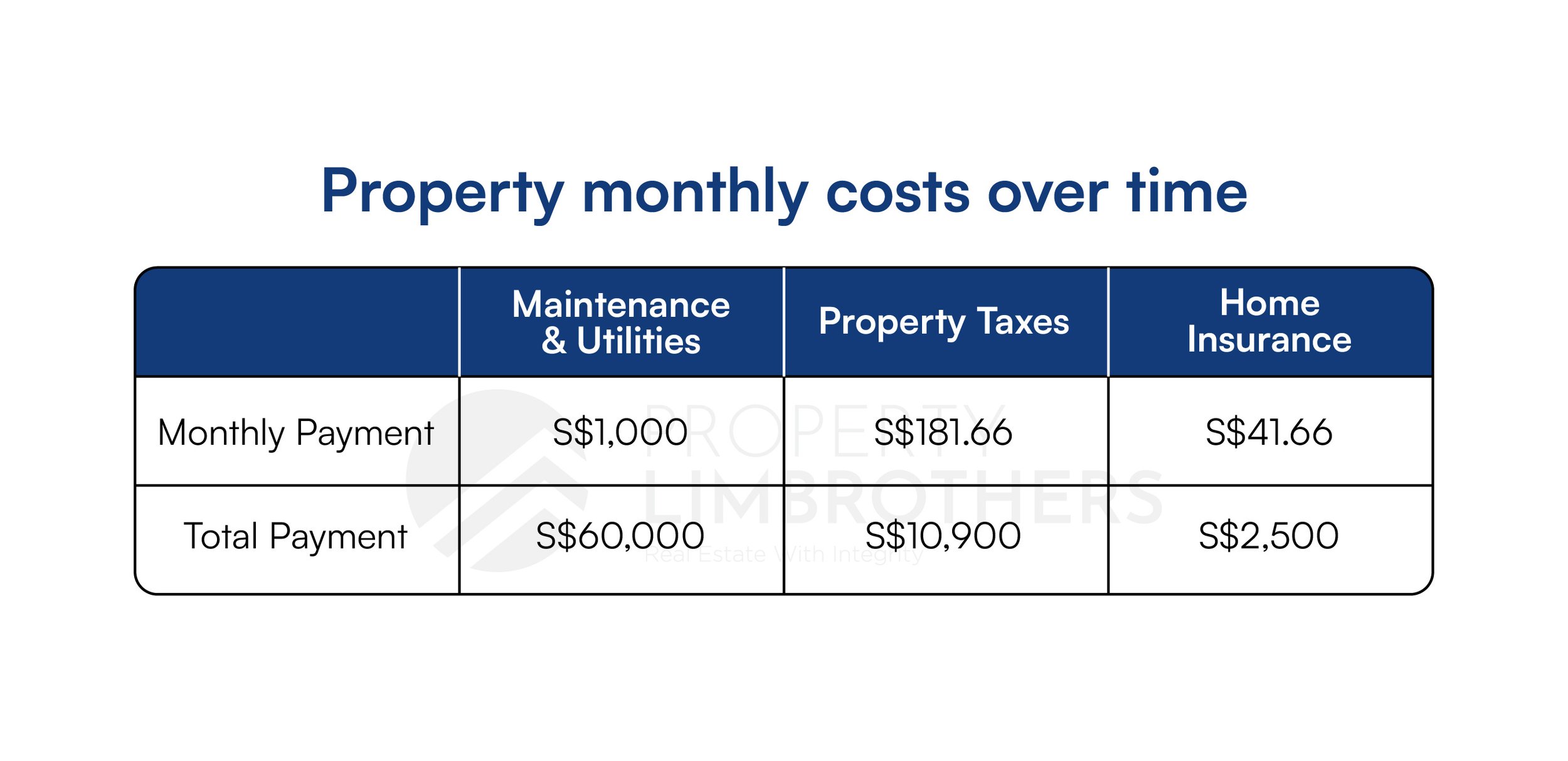

As far as your property related costs go, let’s establish the following: you paid S$12,000 per year in maintenance and utilities, or S$60,000 over 5 years. You paid S$2,180 in annual property taxes, or S$10,900 over 5 years. For home insurance, if you paid S$500 per year, then your total cost over 5 years was S$2500. And when you purchased the property, you paid S$69,600 in BSD. So for these housing related costs, which are sunk costs you can’t recoup, you’ve paid S$143,000.

And the whole time you’ve been living in and taking advantage of the “usability quotient” of your property, it’s been appreciating in value. Singapore is becoming increasingly popular and demand for real estate is going up all the time, which means housing prices are going up as well. For our example, let’s assume the price of your property has appreciated by an average of 5% per year. 5% may sound high, but our co-founder analyses certain types of landed properties in Singapore that have grown at over double that rate!

Since your property was purchased at S$2,000,000 5 years ago, and it has appreciated at 5% per annum, it is now worth S$2,552,563!

Cashing in on the Property’s Profit

Now, let’s consider selling the property. It’s finally time to realise the paper gain you’ve been enjoying while your property has silently appreciated in value every year.

You sell the property at its market value of S$2,552,563. Your outstanding loan on the property, which you owe to the bank, is now S$1,170,000. S$2,552,563 minus the S$1,170,000 owed to the bank is S$1,382,563. And you had S$138,000 in costs for the initial purchase and ongoing maintenance of the property. So S$1,382,563 less S$138,000 is S$1,244,563.

Do think back and remember that you initially put down S$500,000 cash to buy this property, while the bank financed the rest. Now 5 years later, after the labor of love you’ve put into taking care of your property, your S$500,000 is now worth more than twice as much. As a result, you’ve produced an annualised ROI of 20%, or 148% over the total length of time in owning the home. This is a phenomenal return on investment, all while living in and enjoying your property.

Be sure to consider inflation, or the devaluing of money, in your ROI calculations. If annual inflation is 3%, meaning every year your cash is worth 3% less than the year prior, and home prices are increasing by 5% per year, then the real value of your home is increasing by 2%. This is because the 3% inflation eats away at the gains of your property, and makes them worth less. For these more complicated inflation calculations, that’s where our team at PLB comes in. We’re happy to help you calculate the impacts of inflation on your investments moving forward if you want help coming up with an exact calculation.

We want to close this article by reviewing the topic of discussion in today’s article, namely, How to Calculate ROI on the Sale of Your Property and share our tips for you moving forward.

First and foremost, Know Your Numbers

It may sound too basic, but the fundamentals are always the most important part of any deal. Know how much money you need to purchase the property, what your monthly expenses will be, and how the property is expected to appreciate.

Next, keep track of all housing related expenses along the way. Treat your property ownership like your own business. Humans have the unfortunate habit of discounting or forgetting about small expenses over time, or telling ourselves we spent less than we actually did. Keep a document that you update monthly with all housing related costs so you have an accurate understanding of how much you are spending on your investment.

And finally, just remember that all the finances related to your property get placed in one column: assets, or liabilities. The asset column grows when the price of the property appreciates, and when you increase your equity by paying down the principal. The liability column grows when you spend money on maintenance, insurance, taxes, and other costs that come up on the property. Your total ROI on the property is simply how much money you put into a property, and how much you get out of it when you go to sell it. We always recommend our clients safeguard their investment with research. A helpful tool is PLB’s Moat Analysis, where we provide research to assist you in generating positive ROI for your property.

And that’s where our team at PLB comes into play. PLB is driven by the energy and focus of the most talented real estate professionals in Singapore, and we love nothing more than helping our clients build their financial independence through property ownership. If you want to learn more about calculating ROI on your property sale, or want the best help in the industry as you purchase your next property, reach out to us. We live and breathe real estate and are honoured for the chance to help you as well.

Disclaimer: The information provided in this article is accurate as of the date of publication and is based on the rules and regulations concerning stamp duty rates and taxes in effect at the time. While we strive to update our past articles diligently, please be aware that tax laws and regulations can change frequently, and it is essential to verify the most current rules and guidelines from the relevant government authorities or consult with a qualified professional for the latest updates and accurate advice.